By Harshit

SAN JOSE, JANUARY 19 — At first glance, the U.S. technology sector in 2026 appears to be thriving. Investment in artificial intelligence continues to rise, data centers are expanding across the country, and companies are racing to integrate automation into nearly every function. Yet beneath this surge in capital spending lies a surprising contradiction: tech hiring has slowed sharply.

For many American tech workers, the promise of an AI-driven boom has not translated into job security or expanding opportunities.

Capital Is Flowing—But Not to Payrolls

U.S. technology companies are investing heavily, but the nature of that investment has changed. Instead of expanding headcount, firms are allocating capital toward infrastructure: data centers, specialized chips, cloud capacity, and energy systems capable of supporting AI workloads.

These investments are expensive, long-term, and asset-heavy—but they do not require large numbers of new employees. As a result, companies can spend billions while keeping payrolls flat or even shrinking.

This marks a clear break from earlier tech cycles, where growth and hiring rose together.

Efficiency Has Replaced Expansion

After years of rapid hiring during the pandemic-era digital boom, many tech firms entered 2024 and 2025 overstaffed relative to revenue growth. By 2026, executives are under pressure to demonstrate efficiency rather than scale.

AI tools are accelerating this shift. Automation is reducing the need for large teams in customer support, quality assurance, marketing analytics, and even parts of software development. One engineer, supported by advanced tools, can now produce output that once required an entire team.

This efficiency gain benefits margins—but limits job creation.

Hiring Has Become Narrow and Specialized

Tech hiring has not stopped entirely. Instead, it has become far more selective. Demand remains strong for:

- AI researchers and infrastructure engineers

- Cybersecurity specialists

- Semiconductor and hardware experts

- Energy optimization and data center engineers

Meanwhile, generalist software roles, junior positions, and non-technical roles face far stiffer competition. Entry-level opportunities have contracted, making it harder for new graduates to break into the industry.

The Geographic Shift in Tech Jobs

Another quiet change in 2026 is where tech jobs are located. Hiring is increasingly concentrated near data centers, manufacturing hubs, and energy infrastructure rather than traditional tech office clusters.

This has reduced the importance of large corporate campuses while increasing demand in secondary markets. However, these jobs are fewer in number and often require highly specific technical skills.

Worker Anxiety in a Profitable Sector

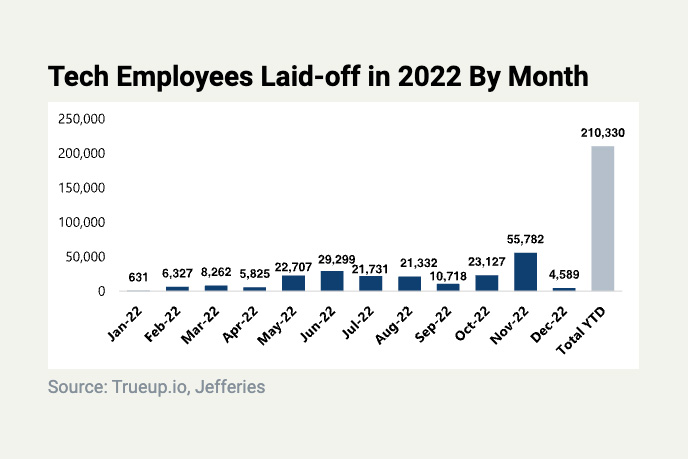

Despite strong balance sheets and rising valuations, worker sentiment in tech has deteriorated. Layoffs in previous years left lasting psychological scars, and the current hiring slowdown reinforces a sense of uncertainty.

Employees are switching jobs less frequently, negotiating less aggressively, and focusing more on job security than career acceleration. This shift is reshaping workplace culture across the industry.

What This Means for the U.S. Economy

The tech sector has long been a major engine of high-wage employment. A prolonged hiring slowdown does not threaten economic collapse, but it does alter income growth dynamics—particularly in cities that rely heavily on technology jobs.

For policymakers and educators, the challenge is aligning training programs with the sector’s increasingly specialized needs.

A Different Kind of Tech Boom

The AI-driven expansion of 2026 is real—but it is not labor-intensive. The winners in this cycle will be companies that control infrastructure and talent at the highest levels, not those that employ the most people.

For U.S. tech workers, the era of automatic opportunity has ended. The new reality rewards specialization, adaptability, and continuous skill upgrading.