By Harshit

AUSTIN, JANUARY 19 — While large American corporations have largely adapted to higher interest rates and tighter financial conditions, millions of small businesses across the United States are facing a far more difficult reality. In 2026, access to affordable credit has emerged as one of the most serious constraints on small-business growth, quietly reshaping entrepreneurship, employment, and local economies.

The issue is not a collapse in demand or a lack of ambition. It is a tightening of credit that is hitting smaller firms far harder than their corporate counterparts.

Credit Is Available—But Not on Small-Business Terms

On paper, lending in the U.S. has not frozen. Banks are still issuing loans, and capital continues to flow through financial markets. However, for small businesses, especially those with thin margins or limited collateral, borrowing conditions have become significantly tougher.

Interest rates on small-business loans remain elevated, reflecting both Federal Reserve policy and lenders’ heightened risk aversion. Loan approval standards have tightened, repayment periods have shortened, and personal guarantees are increasingly required. For many entrepreneurs, the cost of borrowing now outweighs the potential return on expansion.

This has created a paradox: credit exists, but it is no longer accessible on terms that support sustainable growth.

Why Small Businesses Are Hit Harder Than Corporations

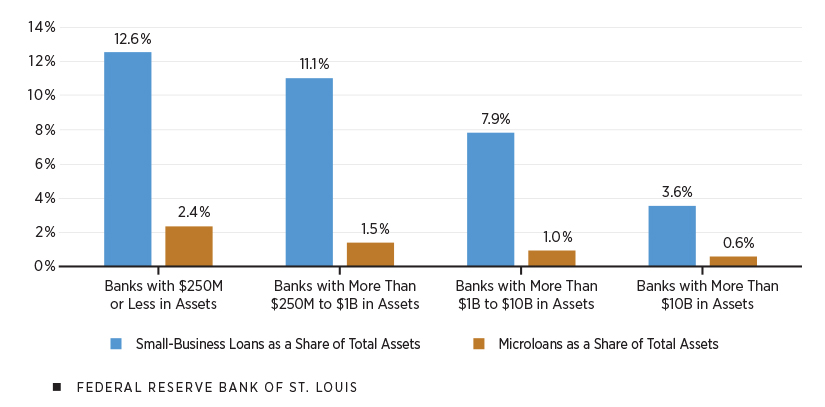

Large corporations benefit from scale, diversified revenue streams, and direct access to capital markets. Small businesses do not. They rely heavily on community banks, regional lenders, and credit unions—institutions that themselves are operating under stricter regulatory and balance-sheet constraints.

In 2026, many banks are prioritizing lower-risk borrowers, such as established corporations or high-credit-score individuals. Small firms, particularly those in retail, hospitality, and services, are viewed as more vulnerable to economic slowdowns and consumer pullbacks.

As a result, entrepreneurs are being asked to prove not just viability, but resilience under worst-case scenarios.

The Impact on Hiring and Local Economies

Small businesses employ nearly half of the U.S. private-sector workforce. When these firms struggle to access credit, the effects ripple outward.

Many owners report delaying hiring, postponing equipment upgrades, or abandoning plans to open new locations. In some cases, businesses are operating profitably but lack the working capital needed to manage cash flow fluctuations caused by seasonal demand or delayed customer payments.

This restraint does not show up immediately in national employment figures, but it weakens job creation over time—particularly in smaller cities and rural communities where small businesses are economic anchors.

Alternative Financing Comes With Trade-Offs

Faced with bank resistance, some entrepreneurs are turning to alternative financing options such as online lenders, merchant cash advances, or private credit platforms. While these sources offer speed and flexibility, they often come at a steep cost.

Higher interest rates, aggressive repayment schedules, and less regulatory oversight can strain already tight cash flows. For many small businesses, alternative financing is a short-term solution rather than a foundation for long-term stability.

Inflation’s Lingering Effects on Margins

Although inflation has eased from its peak, its effects remain embedded in operating costs. Rent, insurance, utilities, and wages are still significantly higher than they were just a few years ago. Small businesses, with less pricing power than large firms, are often unable to pass these costs fully onto customers.

This margin pressure makes lenders even more cautious. Businesses that appear healthy on the surface may struggle to demonstrate the buffers banks now expect.

A Shift Toward Conservative Entrepreneurship

The credit squeeze is subtly changing the character of American entrepreneurship. Fewer founders are pursuing aggressive expansion. More are focusing on cash flow discipline, slower growth, and operational efficiency.

While this conservatism may reduce failure rates, it also risks dampening innovation and local job creation. The U.S. economy has long relied on small businesses as engines of opportunity and upward mobility. Prolonged credit constraints threaten that role.

What Comes Next

Policymakers, banks, and business advocates are increasingly aware of the issue. Some lenders are experimenting with new risk models, and there is renewed discussion around targeted lending programs and credit guarantees. However, meaningful relief is likely to be gradual rather than immediate.

For now, small businesses are adapting—cutting costs, renegotiating leases, and relying more heavily on retained earnings. Their resilience remains strong, but the margin for error is thinner than it has been in years.

Why This Matters

The health of small businesses is inseparable from the health of the U.S. economy. A prolonged credit squeeze may not trigger a crisis, but it can quietly slow growth, reduce employment opportunities, and widen the gap between large corporations and local enterprises.

In 2026, the challenge facing American small businesses is not a lack of ideas or effort. It is access to the financial oxygen needed to grow.