By Harshit

WASHINGTON, Dec. 6 —

A closely watched U.S. inflation measure eased more than expected in September, strengthening the case for the Federal Reserve to lower interest rates at its upcoming policy meeting, according to data released Friday by the Commerce Department after a delay caused by the recent government shutdown.

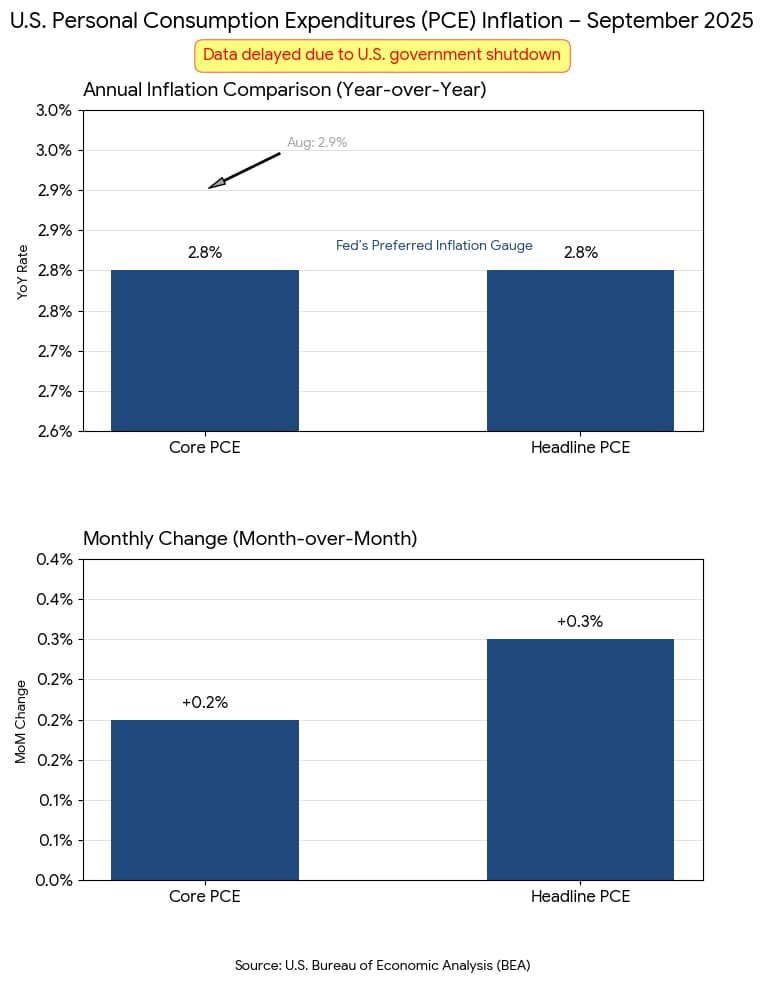

The core Personal Consumption Expenditures (PCE) price index, which excludes volatile food and energy prices and serves as the Fed’s preferred inflation gauge, rose 0.2% month over month, matching economists’ expectations. On a year-over-year basis, core inflation cooled to 2.8%, coming in 0.1 percentage point below forecasts and down from 2.9% in August, signaling continued gradual progress toward the Fed’s inflation target.

Headline PCE inflation, which includes food and energy, increased 0.3% for the month, placing the annual inflation rate also at 2.8%, according to the Commerce Department’s Bureau of Economic Analysis. While the monthly and annual readings broadly matched expectations, the annual headline figure ticked 0.1 percentage point higher than the prior month.

Federal Reserve officials rely heavily on the PCE index when designing monetary policy, with particular weight given to the core measure as a more reliable signal of long-term inflation trends.

“The slightly stale September inflation report shows that prices remained reasonably stable despite tariffs and healthy consumer spending,” said Scott Helfstein, head of investment strategy at Global X. “This probably provides further air cover for the Fed to cut rates in December.”

Tariffs Push Goods Prices Higher, Services Remain Tame

The report highlighted diverging inflation pressures across sectors. Goods prices surged 0.5% in September, reflecting the ongoing impact of tariffs introduced under President Donald Trump, which continue to filter through supply chains.

By contrast, services prices rose just 0.2%, underscoring moderation in the category that accounts for the bulk of consumer spending and has been a focal point for Fed policymakers.

Other components showed mixed movement:

- Food prices: up 0.4%

- Energy prices: up 1.7%

The personal savings rate was unchanged from August at 4.7%, suggesting household financial behavior remains stable despite elevated prices and borrowing costs.

Consumer Income and Spending Show Moderate Growth

Alongside inflation data, the release offered insight into consumer finances. Personal income increased 0.4% in September, beating expectations by 0.1 percentage point, while consumer spending rose 0.3%, falling just short of forecasts.

The combination points to a consumer sector that remains resilient but shows signs of moderation—an outcome the Fed has increasingly sought as it balances inflation control with labor market stability.

The release had been postponed for several weeks due to the federal government shutdown, which halted economic data collection. Despite the lag, the figures represent the final inflation reading the Fed will have before its policy decision next week.

Markets React as Rate-Cut Odds Hold Firm

Financial markets responded positively to the inflation data. Stocks extended gains following the report, as investors grew more confident that easing inflation would allow the Fed to cut interest rates by 25 basis points.

According to the CME Group’s FedWatch Tool, the probability of a rate cut stood at 87.2%, little changed after the release. The Federal Reserve is scheduled to announce its decision Wednesday.

Even so, policymakers remain divided. One faction within the Federal Open Market Committee favors additional rate cuts to preempt labor market weakness, while another prefers caution, citing persistent inflation risks that could warrant keeping policy restrictive for longer.

Labor Market Signals Mixed; Sentiment Improves

Recent economic indicators present a mixed backdrop. Hiring has slowed, and some private-sector data indicate rising layoffs. However, Labor Department figures showed a decline in weekly initial jobless claims, suggesting no sudden deterioration in employment conditions.

Separately, consumer sentiment improved modestly in early December. The University of Michigan’s consumer sentiment index rose to 53.3, up 4.5% from November and above Wall Street expectations.

Importantly, inflation expectations declined, with:

- One-year outlook: 4.1%

- Five-year outlook: 3.2%

Both readings marked their lowest levels since January, reinforcing the view that inflation expectations are becoming better anchored—a critical condition for Fed policymakers considering rate cuts.

As markets await the Fed’s decision next week, the September PCE report—though backward-looking—adds momentum to the argument that inflation is cooling gradually without a sharp economic downturn, potentially allowing the central bank to begin easing policy with greater confidence.