By Harshit, Global Trends Analyst, TodayInUSAndWorld.com

December 11, 2025

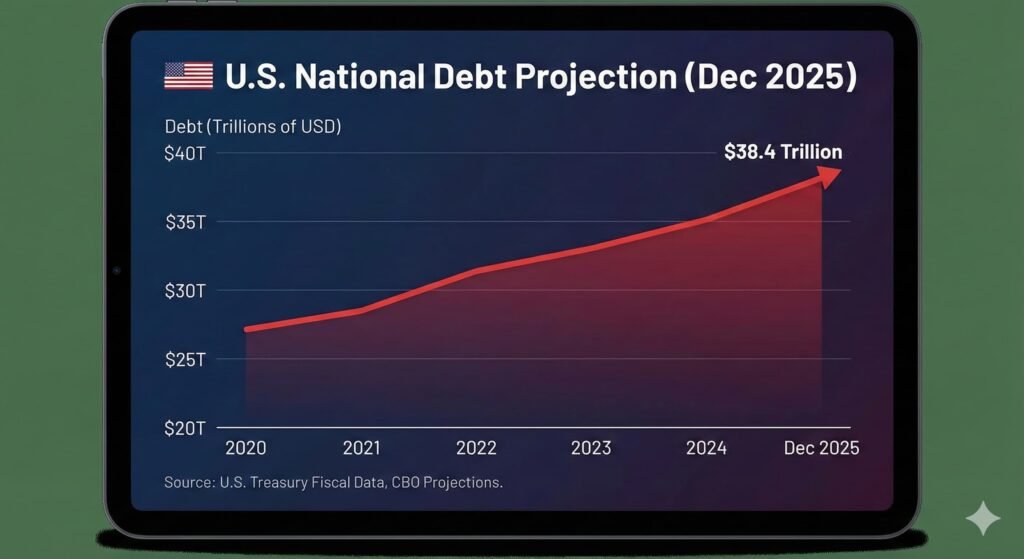

The U.S. national debt has climbed to approximately $38.4 trillion, according to recent Treasury data. This level, captured in early December 2025 and highlighted in Congressional fiscal tracking reports, marks one of the fastest expansions of federal debt in modern history. It is no longer a partisan argument but a structural economic challenge with consequences that will shape American household finances and global capital flows for the rest of the decade.

Federal debt has increased by roughly $2.2 trillion year-over-year, a growth rate driven by elevated federal spending, rising interest costs, and slower-than-expected revenue growth. As the debt trajectory steepens, three major implications are becoming unavoidable.

1. The Fiscal Pressure: Interest Costs Are Surging

Net interest payments have become one of the largest and fastest-growing components of the federal budget. With the effective interest rate on marketable federal debt now in the low-to-mid 3% range, rolling older, low-rate debt into a higher-rate environment is accelerating the government’s interest burden.

What this means:

Crowding Out:

Every dollar spent on interest is a dollar not available for infrastructure, education, scientific research, or national defense. Rising interest outlays reduce fiscal flexibility and narrow the government’s policy options.

Debt-to-GDP Pressure:

Gross federal debt is now near 120% of GDP on commonly used measures. Economists often associate debt levels at or above this threshold with slower long-term growth and reduced fiscal resilience, though impacts depend on interest rates and investor confidence.

Long-Term Risk:

Even if deficits stabilized, interest costs would continue climbing as maturing debt is refinanced at higher rates. This dynamic sets a structural floor under future borrowing needs.

2. The Household Impact: Higher Rates and Lower Purchasing Power

Federal borrowing affects Americans indirectly but powerfully by influencing broader financial conditions.

How this shows up:

Higher borrowing costs:

Persistent Treasury yield pressures translate into higher mortgage rates, auto loan rates, student loan interest, and credit card APRs. Elevated base rates make homeownership more difficult, slow consumer credit expansion, and widen household debt loads.

Inflation perception vs. inflation reality:

While inflation has cooled significantly from its 2022–2023 peaks, price levels remain high, which keeps consumers sensitive to affordability issues even when year-over-year inflation readings decline. This disconnect—lower inflation but higher prices—keeps sentiment weak.

Debt per household:

At $38.4 trillion, federal debt equates to roughly $280,000–$300,000 per U.S. household, depending on the household estimate used. Though symbolic—not an actual tax bill—it captures the scale of the fiscal obligation future generations inherit.

3. The Global Shift: Gradual Diversification Away From U.S. Treasuries

Foreign investors remain essential to U.S. debt markets, holding about $7½ to $7.6 trillion in Treasuries as of late 2025. Demand remains strong, but foreign buyers have become more cautious.

Key global trends:

China is slowly reducing exposure:

Over the past decade, China has trimmed its Treasury holdings, though the process has been gradual rather than disruptive.

Japan remains the largest holder:

Japan’s consistent domestic savings surplus continues to support large-scale Treasury buying, helping stabilize U.S. debt markets.

Emerging-market diversification:

Nations across Asia, the Middle East, and Latin America are increasing allocations to gold, commodities, and non-U.S. sovereign debt to reduce their dependence on the dollar.

The U.S. dollar remains the world’s dominant reserve currency, but maintaining that position requires financial and political credibility. Persistent large-scale borrowing and rising interest costs test that credibility over time.

Analyst’s Outlook: A Decisive Fiscal Decade Ahead

The U.S. is entering a period where interest costs will increasingly constrain national policy, and the margin for fiscal missteps is shrinking. Without a credible, long-term framework that aligns revenue and spending, the federal government will confront difficult trade-offs:

- Slower growth in discretionary spending

- Higher taxes or new revenue models

- Higher borrowing costs

- A heavier interest burden consuming a rising share of the budget

The global financial system is not abandoning the dollar, but it is slowly adapting to a world where U.S. fiscal sustainability is no longer assumed indefinitely. For sophisticated investors, this environment creates both risk and opportunity: understanding the direction, velocity, and endurance of these fiscal pressures will determine who maintains a strategic advantage in the late 2020s.