By Harshit

NEW YORK, DECEMBER 30, 2025

As the United States prepares to enter 2026, the business environment is undergoing a profound transition. The era of easy money, explosive post-pandemic demand, and rapid top-line growth has faded. In its place, a more disciplined, data-driven, and efficiency-focused economy is emerging—one that rewards strategic execution over expansion for expansion’s sake.

For U.S. businesses, 2026 will not be defined by crisis, but by constraint. Interest rates remain structurally higher than the pre-2022 era, labor markets are tighter but cooling, and consumers are increasingly selective. Yet within these constraints lie significant opportunities for companies that adapt quickly to changing cost structures, technological disruption, and shifting consumer behavior.

This is the defining business reality of 2026: slower growth, smarter competition, and higher expectations from investors, workers, and customers alike.

1. The Macro Backdrop: A Normalized but Tighter Economy

By the end of 2025, inflation had moderated substantially from its earlier peaks, but price levels remain elevated relative to historical norms. Growth has slowed toward its long-term trend, with real GDP expected to expand modestly in 2026 rather than accelerate.

For businesses, this means:

- Revenue growth will be harder to achieve organically

- Pricing power will be uneven across industries

- Cost discipline will matter more than headline expansion

The U.S. economy is not entering a recession, but it is also no longer forgiving inefficiency. Investors are increasingly rewarding companies that demonstrate predictable cash flow, pricing discipline, and operational leverage rather than speculative growth narratives.

2. Capital Is More Expensive — and That’s Changing Corporate Behavior

One of the most important shifts for U.S. businesses in 2026 is the permanence of higher borrowing costs. While interest rates may gradually decline, they are unlikely to return to the near-zero environment that defined much of the past decade.

What This Means for Businesses

- Debt-funded expansion is less attractive

- Return on invested capital (ROIC) is under greater scrutiny

- Internal cash generation has become a competitive advantage

Companies are responding by delaying marginal projects, prioritizing high-confidence investments, and strengthening balance sheets. Share buybacks are increasingly favored over aggressive acquisitions unless clear synergies exist.

Private equity firms, facing higher financing costs, are also becoming more selective. As a result, valuations across many sectors have normalized, bringing discipline back into deal-making.

3. The Consumer Is Still Spending — but Differently

U.S. consumer spending continues to account for roughly two-thirds of economic activity, but the composition of that spending is shifting in meaningful ways.

Key Consumer Trends for 2026

- Premiumization at the top: Higher-income households remain resilient, supporting demand for travel, luxury goods, and high-end services.

- Value-seeking in the middle: Middle-income consumers are increasingly price-sensitive, favoring discounts, private labels, and flexible payment options.

- Experience over ownership: Spending on experiences—events, travel, dining—continues to outperform durable goods.

For businesses, this divergence means segmentation matters more than scale. Companies that try to serve everyone equally are finding it harder to maintain margins.

4. Labor Markets: Slowing Hiring, Rising Productivity Pressure

The U.S. labor market is cooling gradually heading into 2026, but it remains structurally tight due to demographics. Retirements, slower immigration growth, and skills mismatches continue to constrain labor supply.

How Businesses Are Responding

- Selective hiring rather than broad workforce expansion

- Increased automation to offset labor shortages

- Greater focus on employee retention and upskilling

Wage growth is moderating but remains elevated in high-skill roles, particularly in technology, healthcare, engineering, and AI-adjacent fields. For employers, the challenge is balancing compensation costs with productivity gains.

The companies that succeed in 2026 will not necessarily have the largest teams, but the most effective and technologically augmented ones.

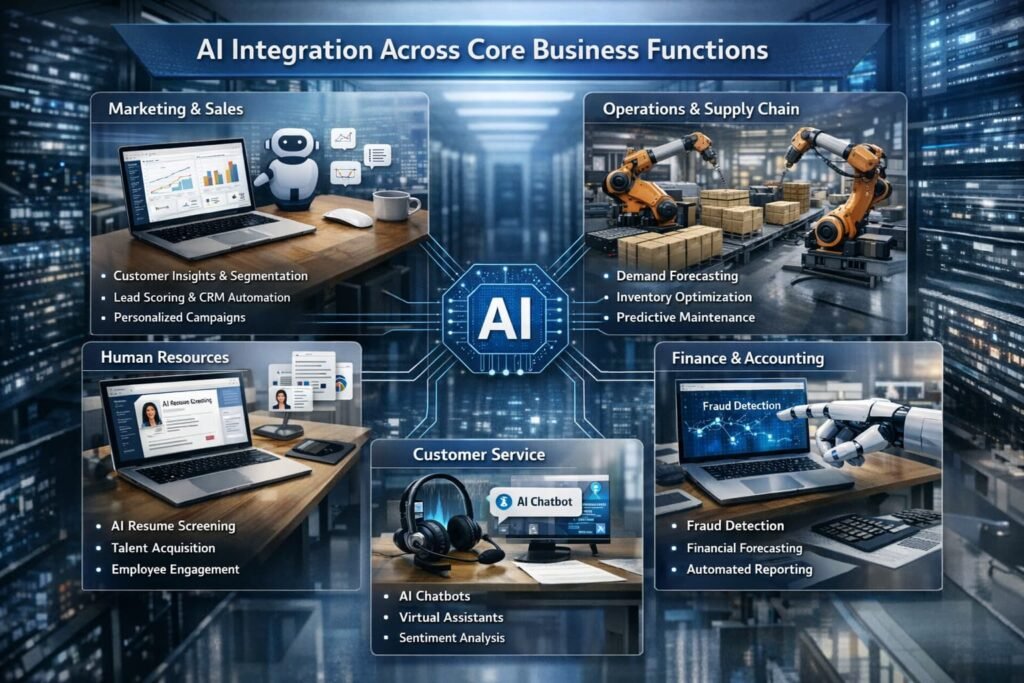

5. Artificial Intelligence Moves From Experiment to Infrastructure

By the end of 2025, Artificial Intelligence had moved beyond pilot projects and into core business operations. In 2026, AI is no longer a competitive differentiator—it is becoming a baseline expectation.

Where AI Is Delivering Real Business Value

- Operations: Demand forecasting, inventory optimization, logistics routing

- Finance: Fraud detection, risk modeling, expense control

- Marketing: Personalization, customer segmentation, pricing optimization

- Customer Service: AI-assisted support rather than full automation

Importantly, businesses are learning that AI works best as an augmentation tool, not a replacement for human judgment. Firms that integrate AI thoughtfully—aligning it with existing workflows—are seeing meaningful productivity gains without cultural disruption.

6. Supply Chains Remain Strategic, Not Just Operational

The disruptions of the early 2020s permanently changed how U.S. companies think about supply chains. In 2026, resilience is valued as highly as efficiency.

Ongoing Supply Chain Priorities

- Nearshoring and reshoring to reduce geopolitical risk

- Supplier diversification to avoid single points of failure

- Technology-enabled visibility across logistics networks

While fully domestic supply chains remain costly, hybrid models are becoming the norm. Businesses are willing to accept slightly higher input costs in exchange for reliability and predictability.

7. Small and Medium Businesses: Lean, Digital, and Resilient

For small and mid-sized U.S. businesses, 2026 will be challenging but navigable. Access to capital is tighter, but digital tools have lowered barriers to efficiency and market access.

Key SMB Survival and Growth Strategies

- Cash-flow discipline over aggressive expansion

- Digital-first sales and marketing

- Outsourcing non-core functions

- Using AI tools for finance, HR, and customer engagement

SMBs that adopt enterprise-grade tools without enterprise-scale costs will be better positioned to compete with larger incumbents.

8. Regulation, Trade, and Political Risk

As the U.S. enters an election-sensitive period, businesses are factoring political risk into planning more actively than in prior cycles. Trade policy, tariffs, and regulatory enforcement remain areas of uncertainty.

However, most companies are planning for policy volatility rather than paralysis. The emphasis is on flexibility—designing strategies that can adapt to multiple regulatory outcomes.

Conclusion: 2026 Will Reward Discipline Over Excess

The U.S. business environment in 2026 is neither booming nor collapsing. It is maturing.

Success will favor companies that:

- Control costs without sacrificing innovation

- Invest in productivity-enhancing technology

- Understand fragmented consumer behavior

- Maintain balance-sheet strength

- Build resilient supply and labor strategies

The next year will not be about chasing growth at any cost. It will be about earning growth through execution, efficiency, and adaptability. For U.S. businesses that internalize this shift, 2026 offers not just survival—but sustainable, long-term opportunity.