By Harshit, Washington, D.C., October 2, 2025 – 7:30 AM EDT

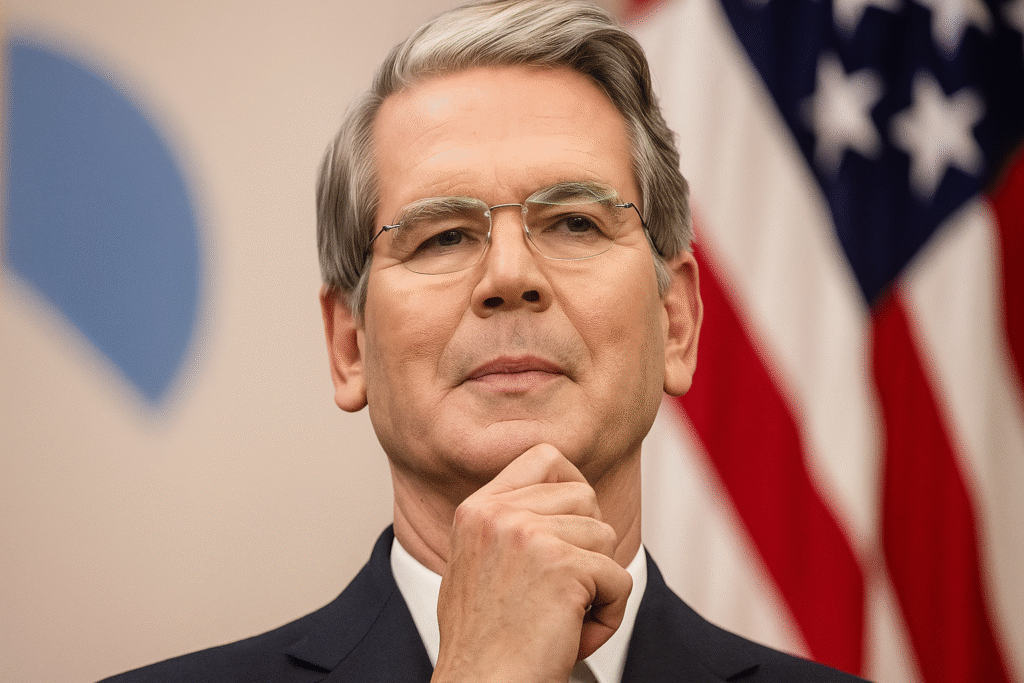

Treasury Secretary Highlights Risks

U.S. Treasury Secretary Scott Bessent warned Thursday that the ongoing government shutdown could weigh on economic growth. Speaking on CNBC’s “Squawk Box,” Bessent said, “This isn’t the way to have a discussion, shutting down the government and lowering the GDP. We could see a hit to the GDP, a hit to growth and a hit to working America.”

The warning comes as federal operations remain halted for a second day in Washington, D.C., with lawmakers unable to reach an agreement on a continuing resolution to fund government spending.

Economic Context

Despite the current political deadlock, the U.S. economy has shown signs of resilience. Gross domestic product (GDP) expanded at a 3.8% annualized pace in the second quarter, and the Atlanta Federal Reserve tracker indicates that the third quarter may mirror that growth. This follows a sluggish start to the year, when economic momentum was limited by low consumer confidence and muted job creation.

However, Bessent cautioned that even if past shutdowns had little lasting effect on growth, this situation carries additional risks. A prolonged stoppage could dampen business and consumer confidence, slow federal spending, and potentially reduce employment if President Donald Trump acts on threats to permanently lay off federal employees. Approximately 750,000 workers are affected by the current closure.

Historical Perspective on Shutdowns

Traditionally, short-term government shutdowns have had minimal impact on overall GDP growth. Previous interruptions often lasted a few days or weeks and saw government operations resume with limited economic fallout. However, the scale of the current shutdown, combined with proposed permanent layoffs, has raised concerns among economists about potential negative effects on consumer spending, business activity, and financial markets.

Market and Policy Implications

Investors are closely monitoring developments, particularly as data releases like the September jobs report may be delayed or postponed due to the shutdown. Treasury yields and equity markets could react to prolonged uncertainty, and the Federal Reserve’s policy decisions may be influenced if economic data becomes incomplete or delayed.

“This is a situation where policy uncertainty could weigh on markets and growth simultaneously,” said an economic analyst at a Washington-based research firm.

Outlook and Analysis

The U.S. government shutdown underscores the fragile balance between political negotiation and economic performance. While growth has been solid in recent quarters, a longer impasse may disrupt federal operations, reduce workforce participation, and create ripple effects in private-sector confidence. Analysts note that even temporary halts in government services can slow contracting, permit approvals, and federal payments, which in turn affects broader economic activity.

Treasury Secretary Bessent’s comments serve as a reminder that government functionality is a key component of economic stability, especially as the nation approaches the final months of 2025. The duration of the shutdown and potential layoffs remain critical factors for predicting near-term GDP outcomes.