By Harshit

WASHINGTON, NOV. 17 —

U.S. Treasury yields slipped on Monday as investors prepared for a dense week of long-delayed economic reports — the first meaningful read on the economy since the record-long government shutdown halted federal data releases for 43 days.

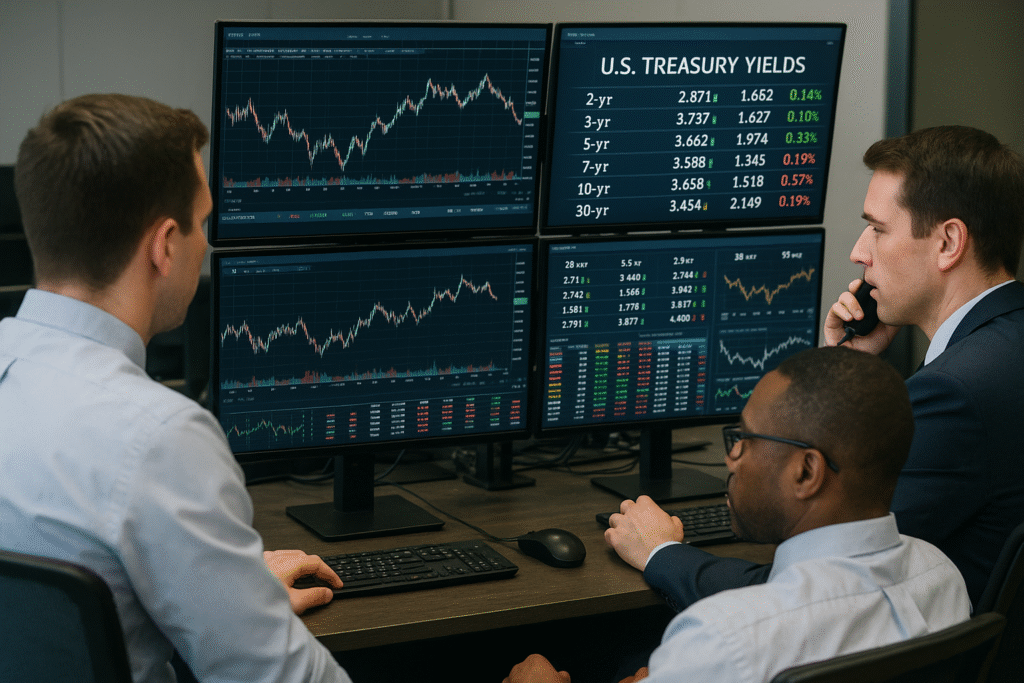

The 10-year Treasury yield dipped slightly to 4.139%, down less than one basis point. The 2-year yield, which is more sensitive to interest rate expectations, also eased by less than a basis point to 3.606%, while the 30-year yield slipped to 4.741%.

(One basis point equals 0.01%. Yields fall when bond prices rise.)

| Treasury | Latest Yield | Change |

|---|---|---|

| 10-Year | 4.142% | -0.006 |

| 2-Year | 3.610% | -0.004 |

| 30-Year | 4.741% | -0.005 |

| 1-Month | 3.966% | +0.005 |

| 6-Month | 3.834% | +0.010 |

The modest downward move reflects investors staying cautious but steady as they await critical data releases that will help define expectations for the Federal Reserve’s December interest rate decision.

Government Shutdown Ends, Data Releases Restart

The brief calm in bond markets comes after President Donald Trump signed the long-delayed funding bill last week to end the 43-day government shutdown, the longest in U.S. history.

The shutdown froze dozens of core economic reports, including:

- Consumer Price Index (CPI)

- Producer Price Index (PPI)

- Nonfarm payrolls

- JOLTS labor openings

- Housing and construction data

- International trade balance

White House press secretary Karoline Leavitt warned that some datasets may never be fully reconstructed, but federal agencies have moved quickly to release the most economically sensitive figures.

This week marks the return of the first major batch.

Nonfarm Payrolls Report Takes Center Stage

The most closely watched release will be September’s nonfarm payrolls report, scheduled for Thursday. It is the first major dataset that went missing during the shutdown, and the numbers will help investors and the Fed assess the direction of the labor market.

Economists expect payroll growth to have slowed meaningfully, with unemployment edging upward — trends that have already appeared in private-sector data releases during the shutdown.

“The payrolls report is the most important number this week,” said a senior fixed-income strategist at Raymond James. “The Fed cannot make a December decision without clean labor market visibility.”

Other Key Reports Returning This Week

Along with jobs data, markets will get several delayed indicators, including:

- August construction spending (due Monday)

- August trade balance (due Wednesday)

- Wholesale inventories and factory orders (later in the week)

- FOMC minutes (Thursday)

Investors expect the Fed’s minutes to reveal how much internal concern there was about missing economic data as officials debate whether a December interest rate cut is still justified.

Before the shutdown, markets were pricing in a near-certain rate cut. As of Monday morning, odds of a December cut stand around 53%, according to the CME FedWatch tool — essentially a coin flip.

Bond Market Reaction: Calm Before the Data Storm

Treasury yields remained in a narrow range Monday, signaling that traders are reluctant to reposition until the backlog of economic information becomes available.

“Bond markets are basically in a holding pattern,” said an analyst at BofA Securities. “The shutdown created a data vacuum, and now markets need to digest two months of information in one week.”

Lower yields often indicate rising demand for safe-haven assets, suggesting investors are hedging against the possibility that incoming data may show a sharper-than-expected slowdown.

Fed Outlook: December Decision Hinges on This Week

The Federal Reserve will have only a short window to analyze the restored data flow before its December meeting. The shutdown created uncertainty for officials who rely on data to gauge:

- Labor demand

- Wage pressures

- Consumer spending

- Inflation momentum

- Overall economic resilience

If payrolls come in soft and trade data weakens, pressure will grow on the Fed to resume cutting rates — especially as several officials have expressed concerns about a “softening but not collapsing” labor market.

Markets are also watching for any clues about whether the Fed will end quantitative tightening (QT) sooner than expected amid tightening liquidity conditions.