By Harshit

Washington, D.C. | November 16, 2025 | 1:45 AM EDT

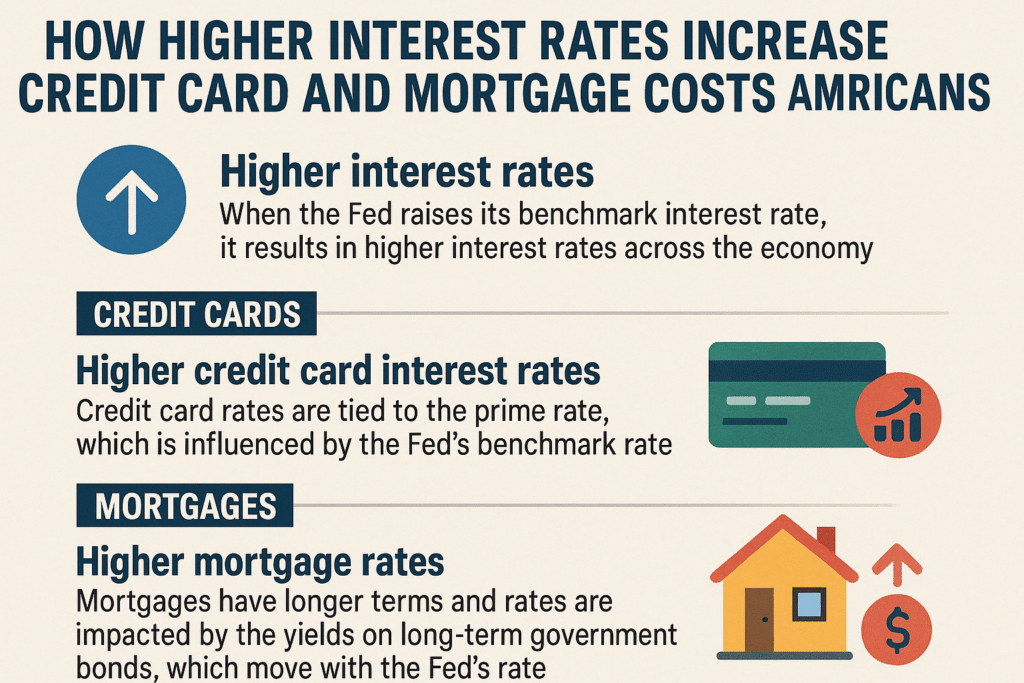

Interest rates shape nearly every part of the American economy, from the price of a home to the monthly interest on a credit card. When the Federal Reserve raises or lowers interest rates, the effects ripple quickly through mortgages, car loans, personal loans, business borrowing, savings accounts, and even job growth.

Yet most people only see interest rates as numbers on a news ticker, without realizing how deeply they influence day-to-day life. This guide explains, in simple terms, what interest rates are, why the Federal Reserve changes them, and how those changes directly affect the wallets of millions of Americans.

What Are Interest Rates, and Who Controls Them?

The Federal Reserve (the Fed) is the central bank of the United States. One of its most important jobs is controlling the federal funds rate, the benchmark interest rate that influences all borrowing costs in the country.

Banks use this rate to determine:

- mortgage rates

- auto loans

- student loans

- credit card interest

- personal loans

- small business loans

When the Fed raises rates, borrowing becomes more expensive.

When the Fed cuts rates, borrowing becomes cheaper.

The Fed adjusts rates mainly to influence:

- inflation

- economic growth

- employment levels

Interest rates are the Fed’s most powerful tool for stabilizing the economy.

Why Interest Rates Changed So Much in Recent Years

From 2022–2024, the United States saw its highest inflation in four decades.

Prices rose sharply for:

- groceries

- rent

- gas

- electricity

- cars

- travel

To slow inflation, the Federal Reserve aggressively raised interest rates.

When borrowing becomes expensive, people and businesses spend less. That reduces overall demand and eventually cools down rising prices.

By 2025, inflation eased, and the Fed began discussing potential rate cuts. But the effects of earlier hikes are still felt in major parts of American life — especially in housing and credit cards.

How Interest Rates Affect Mortgages

For many Americans, a house is the biggest purchase of their lives. Interest rates can change the cost of a home by tens or even hundreds of thousands of dollars over a 30-year mortgage.

1. Higher Rates = Higher Monthly Payments

Example:

A $400,000 mortgage at 3% interest → around $1,700/month

The same mortgage at 7% interest → around $2,660/month

That’s nearly $1,000 more each month.

This is why many renters postponed buying homes in 2023–2025 — mortgage rates reached their highest levels in two decades.

2. Housing Prices React Slowly

High interest rates reduce how many people can afford a home.

Demand drops, but home prices in the U.S. stayed high because:

- inventory is very low

- construction slowed after the pandemic

- homeowners with 2–3% mortgages refuse to sell

This “lock-in effect” froze the market, leading to fewer sales.

3. Adjustable-Rate Mortgages (ARMs) Become Risky

When rates were low, many Americans took ARMs.

When rates rose sharply, their monthly payments increased dramatically — causing financial strain.

How Interest Rates Affect Credit Cards

This is where rate hikes hurt Americans the most.

1. Credit Card APRs Are Very High

Most U.S. credit cards have variable APRs tied directly to the Fed’s decisions.

When the Fed hikes rates, credit card APRs go up within one to two billing cycles.

Average credit card APR in 2025:

➡ 22% to 27%

This means carrying a balance has become extremely expensive.

2. Minimum Payments Increase Slowly, But Debt Lasts Longer

Even a small balance grows quickly.

Example:

A $1,000 balance at 25% APR → $250 in interest per year

A $5,000 balance → more than $1,200 in interest per year

Millions of Americans now rely on credit cards for essentials like groceries and rent, so rate hikes hit lower-income households hardest.

3. Credit Score Impact

Higher interest means:

- people pay late more often

- balances increase

- utilization goes up

- credit scores fall

This reduces access to future loans and increases borrowing costs even more.

How Interest Rates Affect Car Loans

Car loans are also sensitive to rate changes.

1. Higher Monthly Payments

Average auto loan interest in 2025:

- New cars: 7–10%

- Used cars: 10–16%

A $35,000 new car at 4% interest → $645/month

At 9% interest → $775/month

That’s $130 more each month.

2. Used Car Buyers Are Hit Hardest

Lower-income families usually buy used cars, where rates are highest.

How Interest Rates Affect Personal Loans

Personal loans are often used for:

- medical bills

- emergency costs

- weddings

- debt consolidation

- home repairs

Rates vary widely:

- 10–25% average

Higher Fed rates → higher personal loan rates → more expensive emergencies.

How Interest Rates Affect Savings, CDs, and Money Market Accounts

Not all effects are negative.

1. Higher Rates = Better Returns for Savers

High interest rates increase:

- High-yield savings accounts

- Certificates of Deposit (CDs)

- Money market accounts

Many banks now offer:

- 4–5.5% returns on savings

- 5–6% on CDs

Older Americans with savings benefit the most.

2. But Banks Don’t Always Pass the Full Rate

Large banks often keep savings rates low while smaller online banks offer higher rates.

How Interest Rates Affect Jobs and the Economy

Higher rates reduce borrowing → businesses spend less.

This leads to:

- fewer new jobs

- slower wage growth

- weaker investment

- lower stock market performance

That’s why the Fed must be careful:

Raise rates too much → recession.

Cut rates too fast → inflation returns.

Why Understanding Interest Rates Matters

Interest rates affect:

- rent decisions

- home buying

- credit card bills

- auto loans

- business growth

- inflation

- retirement savings

- emergency finances

Every American interacts with rates — often without realizing it.

When the Fed adjusts rates, it’s not just an economic policy. It’s a decision that shapes the financial stability of millions of households.