By Harshit

NEW YORK, DECEMBER 27, 2025 —

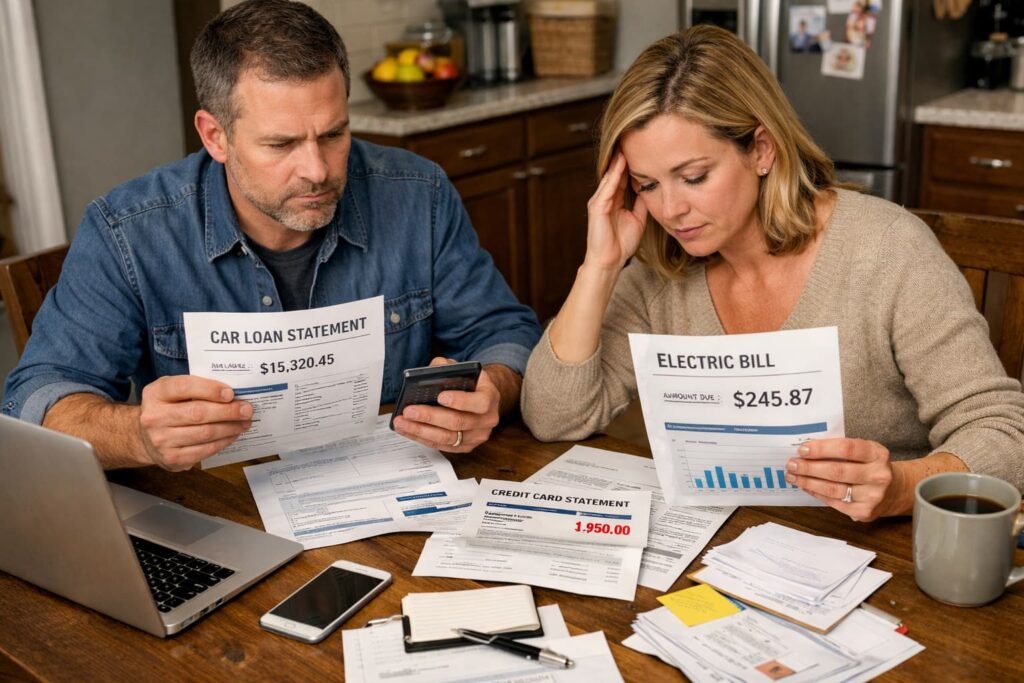

As 2025 draws to a close, household debt remains one of the most persistent pressures shaping the U.S. economy. Despite steady employment and moderating inflation, many American households continue to face financial strain due to elevated borrowing costs and accumulated debt from previous years.

While debt levels alone do not indicate economic distress, the cost of servicing that debt has become a defining factor influencing consumer behavior, savings decisions, and overall economic momentum.

The Composition of Household Debt

U.S. household debt is spread across several major categories, including mortgages, credit cards, auto loans, and student loans. Mortgages still account for the largest share, but consumer credit—particularly credit card balances—has drawn increased attention in 2025.

Higher interest rates raised the cost of revolving debt, making credit cards significantly more expensive to carry. Even households with stable incomes found that interest charges consumed a larger portion of monthly budgets, reducing flexibility for discretionary spending.

Auto loans also remained costly, as elevated vehicle prices and financing rates combined to increase monthly payment burdens.

Interest Rates and Debt Servicing

The policy stance of the Federal Reserve continued to influence household finances throughout the year. Although inflation slowed, interest rates remained high enough to discourage aggressive borrowing and refinancing.

For households with variable-rate debt, rate adjustments translated directly into higher payments. Fixed-rate borrowers were less affected but faced limited refinancing opportunities compared to earlier low-rate periods.

Economists note that these conditions encouraged financial caution rather than panic, signaling adjustment rather than systemic stress.

Impact on Consumer Spending

Consumer spending, the largest driver of U.S. economic activity, showed resilience in 2025 but lacked the momentum seen in earlier expansion phases. Households prioritized essentials and debt repayment over discretionary purchases.

Retailers observed more price sensitivity, with consumers favoring discounts and value-oriented options. Big-ticket purchases were often delayed, reflecting concern about long-term affordability rather than immediate income constraints.

This moderation in spending helped stabilize household balance sheets but contributed to slower growth in consumer-driven sectors.

Income, Savings, and Inequality

Debt pressures were not evenly distributed. Lower- and middle-income households experienced greater strain because debt servicing represents a larger share of income. Higher-income households generally maintained stronger balance sheets but still displayed caution due to uncertainty about future costs.

Savings rates remained higher than pre-pandemic norms, reflecting a collective preference for financial buffers. Economists view this as a rational response to economic volatility rather than a sign of pessimism.

What This Means for the Economy

From a macroeconomic perspective, household debt in 2025 functioned as a stabilizing force rather than a destabilizing one. Elevated borrowing costs discouraged excessive leverage, reducing the risk of sudden financial shocks.

At the same time, restrained consumer behavior limited the pace of economic acceleration, reinforcing a slower but more sustainable growth pattern.

Outlook for 2026

Looking ahead, household debt dynamics will depend heavily on interest rate trends, wage growth, and inflation expectations. A gradual easing of borrowing costs could provide relief, but economists caution against expecting a return to ultra-low-rate conditions.

As 2025 demonstrated, the U.S. economy can remain resilient even as households operate under tighter financial constraints, provided employment remains strong and credit markets remain functional.