By Harshit, Washington, D.C., October 29, 2025 – 8:30 AM EDT

Fiserv Faces Sharp Market Sell-Off After Disappointing Q3 Results

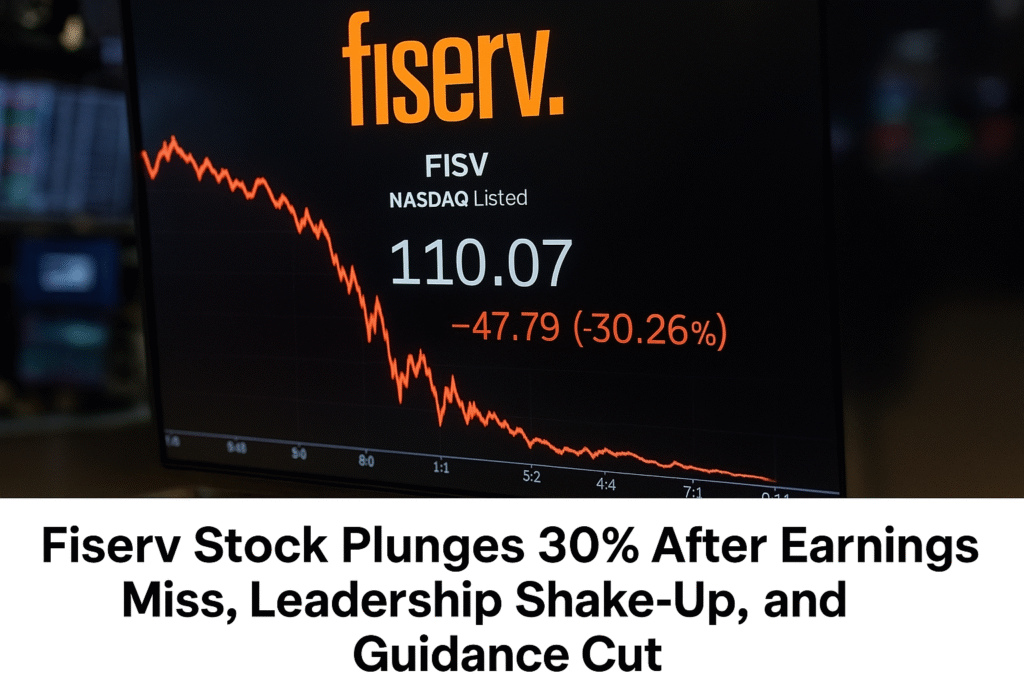

Shares of Fiserv (FI) tumbled 30% on Monday after the global payment technology company announced a sweeping leadership overhaul, a new strategic “One Fiserv” action plan, and a drastic cut to its 2025 earnings guidance following a weak third-quarter performance.

The company’s third-quarter earnings and revenue both missed Wall Street expectations, leading to a massive sell-off as investors reacted to the weaker outlook and signs of slowing growth across key business units.

Slashed Guidance and Weak Growth Outlook

Fiserv cut its full-year 2025 EPS guidance to a range of $8.50–$8.60 (midpoint $8.55), well below the $10.16 analyst consensus and its previous projection of $10.15–$10.30. The company also reduced its organic revenue growth forecast to 3.5%–4%, compared with the earlier expectation of roughly 10%.

For the third quarter, Fiserv reported an adjusted EPS of $2.04, missing the average analyst estimate of $2.65. That figure also marked a decline from $2.47 in Q2 and $2.30 in Q3 2024.

Quarterly adjusted revenue came in at $4.92 billion, missing the $5.35 billion consensus, down from $5.20 billion in the previous quarter, though slightly up from $4.88 billion a year ago.

“Our current performance is not where we want it to be nor where our stakeholders expect it to be,” said CEO Mike Lyons, acknowledging the company’s challenges during a press briefing.

Leadership Overhaul and Board Refresh

As part of a major restructuring, Fiserv announced several executive changes and board appointments aimed at refocusing the company’s operations and strategy.

- Takis Georgakopoulos, current COO of Technology and Merchant Solutions, and Dhivya Suryadevara, former CEO of Optum Financial Services and Optum Insight at UnitedHealth Group, were named co-presidents, effective December 1, 2025.

- Paul Todd, former CFO of Global Payments, was appointed Chief Financial Officer, effective October 31, 2025, succeeding Robert Hau, who will serve as a senior advisor through Q1 2026.

- On the board, Gordon Nixon, Céline Dufétel, and Gary Shedlin will join as new members on January 1, 2026. Nixon will become independent chairman, replacing Doyle Simons, who will step down. Shedlin will head the audit committee after Kevin Warren exits.

Additionally, Fiserv will transfer its Class A common stock listing from the NYSE to Nasdaq, effective November 11, 2025, where it will continue trading under the ticker “FISV.”

The “One Fiserv” Action Plan

Alongside leadership changes, Fiserv unveiled its One Fiserv action plan, designed to sharpen client focus and improve operational efficiency across five strategic pillars:

- Operate with a client-first mindset to attract new enterprise clients and increase revenue per customer.

- Build the leading small-business platform through Clover, Fiserv’s merchant service unit.

- Develop innovative financial and commerce platforms, including embedded finance and stablecoin initiatives.

- Drive operational excellence using artificial intelligence and automation.

- Pursue disciplined capital allocation for sustainable long-term growth.

Fiserv emphasized that the plan aims to restore investor confidence and deliver consistent performance in a rapidly evolving fintech landscape.

Q3 Segment Performance and Margins

Fiserv’s organic revenue grew just 1% year-over-year, reaching $4.93 billion, below the Visible Alpha consensus of $5.33 billion. The company’s Merchant Solutions unit saw 5% Y/Y growth, while Financial Solutions revenue fell 3%.

Operating margins declined across divisions. The company’s adjusted operating margin dropped to 37.0%, down from 39.6% in Q2 and 40.2% a year earlier. Merchant Solutions posted a margin of 37.2%, slightly up from 34.6% last quarter, while Financial Solutions dropped sharply to 42.5%, from 48.7% in Q2.

Total expenses increased to $3.83 billion, compared with $3.82 billion in Q2 and $3.61 billion in the same quarter last year.

Looking Ahead

Despite the steep sell-off, Fiserv’s leadership remains optimistic about the company’s long-term potential. CEO Mike Lyons said Fiserv’s scale, product diversity, and AI-driven innovation pipeline will position it well for future growth.

“As the world’s largest fintech, Fiserv has the suite of innovative platforms, networks, and tools needed to capitalize on the rapidly evolving finance and commerce landscape,” Lyons said.

Investors, however, appear to be demanding results before regaining confidence. With weaker earnings, slowing revenue, and sweeping leadership transitions, Fiserv faces a critical few quarters to prove its turnaround plan can deliver sustainable growth.