London, October 1, 2025 – 8:45 AM EDT — By Harshit

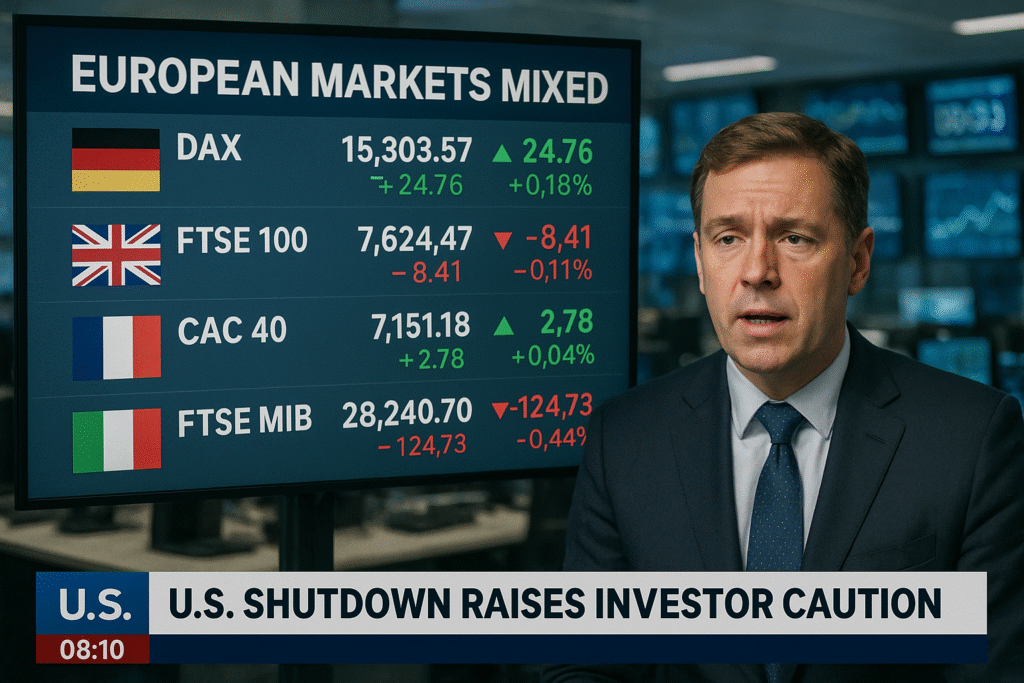

European stocks opened mixed on Wednesday as global investors reacted to the U.S. government shutdown, which has halted critical economic data releases and raised fresh uncertainty for markets.

The pan-European Stoxx 600 was up 0.6% as of 1:45 p.m. in London, with most major sectors in positive territory. The gains came despite caution over political gridlock in Washington and new signs of economic headwinds across the euro zone.

European Market Movers

The Stoxx 600 added 3.1% in the third quarter, supported by strong performances in Spain, the banking sector, and semiconductor giant ASML.

Shares of engineering firm Arcadis surged 8.2% after unveiling a €175 million ($205 million) share buyback program. The company also confirmed Simon Crowe as its new Chief Financial Officer, a move that had been anticipated since September.

German science and technology firm Merck rose 6.6% after announcing leadership changes. Deputy CEO Kai Beckmann will succeed current CEO Belén Garijo, who will step down in April 2026.

Pharmaceutical stocks broadly advanced following President Donald Trump’s announcement of new measures aimed at lowering U.S. drug prices. AstraZeneca climbed 7.2%, while Roche Holdings added 6.5%, Zealand Pharma gained 3.8%, and Novo Nordisk was up 2.6%.

U.S. Shutdown Overshadows Outlook

Overnight, the U.S. government officially shut down after Democrats and Republicans — led by President Trump — failed to agree on a short-term funding measure. The closure means key economic releases, including Friday’s nonfarm payrolls, will be delayed.

The absence of crucial labor market data clouds the Federal Reserve’s policy outlook just weeks ahead of its next meeting. Analysts say the uncertainty could add volatility to global equity and bond markets in the days ahead.

Geopolitical Concerns in Europe

European leaders are also grappling with heightened security tensions. Regional officials are meeting in Copenhagen on Wednesday to discuss responses to repeated airspace incursions in countries including Denmark, Poland, Romania, and Estonia.

Luxembourg Prime Minister Luc Frieden told reporters that Russia remains a persistent threat. “We clearly see that Russia has become a permanent threat to European security,” he said. “There’s a certain kind of provocation that we have to take seriously, though Europe is not at war with Russia.”

Defense stocks sold off ahead of the summit. Shares of German defense prime Renk dropped 4.2%, while military contractor Hensoldt declined 2.7%.

Corporate Developments

In Spain, the takeover battle between domestic banks intensified. Sabadell’s third-largest shareholder, David Martinez, announced support for BBVA’s hostile bid, despite Sabadell’s board urging shareholders to reject the offer.

The revised deal values Sabadell at €16.97 billion ($19.78 billion), marking one of the largest banking consolidation moves in Europe this year.

Inflation and Economic Data

Investors also parsed fresh inflation numbers from the euro zone. Eurostat reported consumer prices rose 2.2% year-on-year in September, in line with expectations and slightly above August’s 2% pace. The services sector recorded the sharpest increase, at 3.2%, followed by food, alcohol, and tobacco at 3%.

Elsewhere, the UK Nationwide House Price Index came in stronger than forecast, rising 2.2% year-on-year in September, up from 2.1% in August. The figures suggest tentative signs of stability in Britain’s housing market.

Meanwhile, manufacturing activity in Russia continued to weaken. The S&P Global Russia Manufacturing PMI dropped to 48.2 in September, marking its steepest contraction in more than three years.

Global Market Reaction

Across Asia, markets traded mixed on Wednesday as investors digested news of the U.S. shutdown. Wall Street futures also edged lower, signaling a cautious open in New York.

Despite regional gains in Europe, analysts warned that the combination of political gridlock in Washington, rising inflation pressures in Europe, and ongoing geopolitical risks could weigh on sentiment in the weeks ahead.