By Harshit, Tokyo | October 19, 2025 8 AM

South Korea Kospi Reaches Record Amid IMF Growth Upgrade

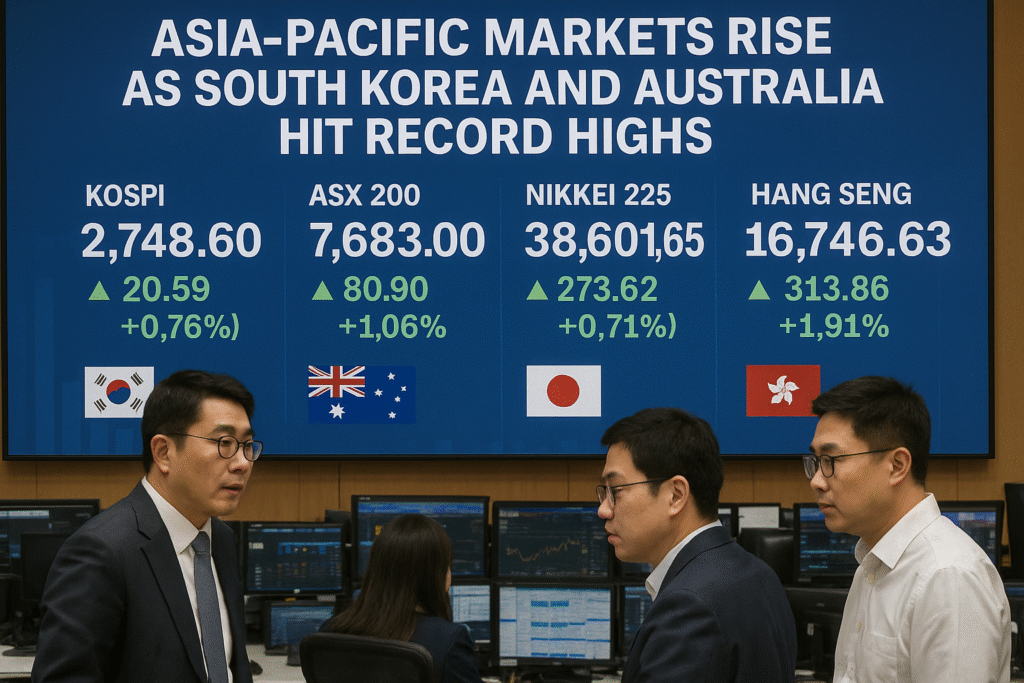

Asia-Pacific markets saw broad gains on Thursday, with South Korea’s Kospi index hitting an all-time high following a revised growth outlook from the International Monetary Fund (IMF). The IMF upgraded South Korea’s 2025 GDP forecast to 0.9% from 0.8%, citing resilient private sector activity and agile supply chain adjustments in the face of global trade challenges.

The IMF also raised its global growth projection, noting that the impact of U.S. tariffs on trade had been “modest.” Factors supporting the forecast included front-loaded imports by South Korean firms, trade agreements between the U.S. and other nations, and overall restraint in the global trading system, which maintained market openness despite tensions.

South Korean equities further benefited from trade negotiations with the U.S.. U.S. Treasury Secretary Scott Bessent told CNBC that Washington was “about to finish up” talks with Seoul, adding, “The devil’s in the details, but we are ironing them out.”

The Kospi index surged 2.49% to close at 3,748.37, while the Kosdaq held steady at 865.41. Technology, automotive, and industrial equipment companies led gains, with Samsung Electronics rising 2.84% to a record high. Hyundai Motor jumped over 8%, while Kia added 7.23%.

However, not all South Korean stocks rose. Shares of SK Inc. fell more than 5% after the Supreme Court partially overturned a previous ruling regarding Chairman Chey Tae-won’s divorce settlement, a case that initially involved a $1 billion payout. Meanwhile, SK Hynix gained 7.1% amid positive sentiment in the semiconductor sector.

Australia’s ASX Surges Despite Rising Unemployment

Australia’s ASX/S&P 200 index also reached a new record, rising 0.86% to 9,068.4, despite a seasonally adjusted unemployment rate climbing to 4.5% in September—its highest in nearly four years. Economists polled by Reuters had expected a 4.3% rate, while August’s unemployment was 4.2%.

Employment growth missed expectations, with the economy adding 14,900 jobs, compared to the forecasted 20,000 increase. The weaker-than-expected labor data is seen by analysts as creating room for further interest rate cuts, supporting equity markets and bolstering investor confidence in domestic consumption and housing sectors.

Mixed Performance Across Asia

Japan’s benchmark Nikkei 225 index climbed 1.27% to 48,277.74, while the broader Topix index added 0.62% to 3,203.42.

In contrast, Hong Kong markets remained mixed. The Hang Seng Index closed flat at 25,888.51, while the Hang Seng Tech Index declined 1.18% to 6,003.56. The downturn was driven by Nio, which saw shares plunge 9% after Singapore’s sovereign wealth fund filed a lawsuit in the Southern District of New York. The case alleges Nio violated securities laws by inflating revenues and names CEO Li Bin and former CFO Feng Wei as defendants.

China’s CSI 300 index managed modest gains, adding 0.26% to 4,618.42. Meanwhile, India’s Nifty 50 and BSE Sensex advanced 0.85% each as of early afternoon trading.

U.S. Market Futures Support Optimism

Overnight, U.S. equity futures traded slightly higher after major banks reported better-than-expected earnings, despite ongoing uncertainty from the third-week federal government shutdown and escalating U.S.-China trade tensions.

The Dow Jones Industrial Average ended the session marginally lower, down 17.15 points (-0.04%) at 46,253.31, although intraday gains reached 422.88 points. The S&P 500 closed up 0.4% at 6,671.06, with intraday gains of up to 1.2%, and the Nasdaq Composite added 0.7% to 22,670.08, rallying as much as 1.4% during the session.

Outlook for Asia-Pacific Markets

Analysts note that regional market strength is being driven by a combination of positive economic forecasts, trade negotiations, and central bank policies, which are expected to continue influencing capital flows and investor sentiment.

In South Korea, the Kospi’s record performance reflects confidence in corporate earnings and a resilient industrial base, while Australia’s equity gains suggest that investors are pricing in potential rate cuts amid weaker labor data.

However, geopolitical tensions and legal disputes, such as the Nio lawsuit, highlight ongoing risks that could impact markets in the short term. Investors are advised to remain cautious while focusing on long-term fundamentals, including trade outcomes, corporate performance, and global growth trends.