By Harshit

NEW YORK, Nov. 24, 2025

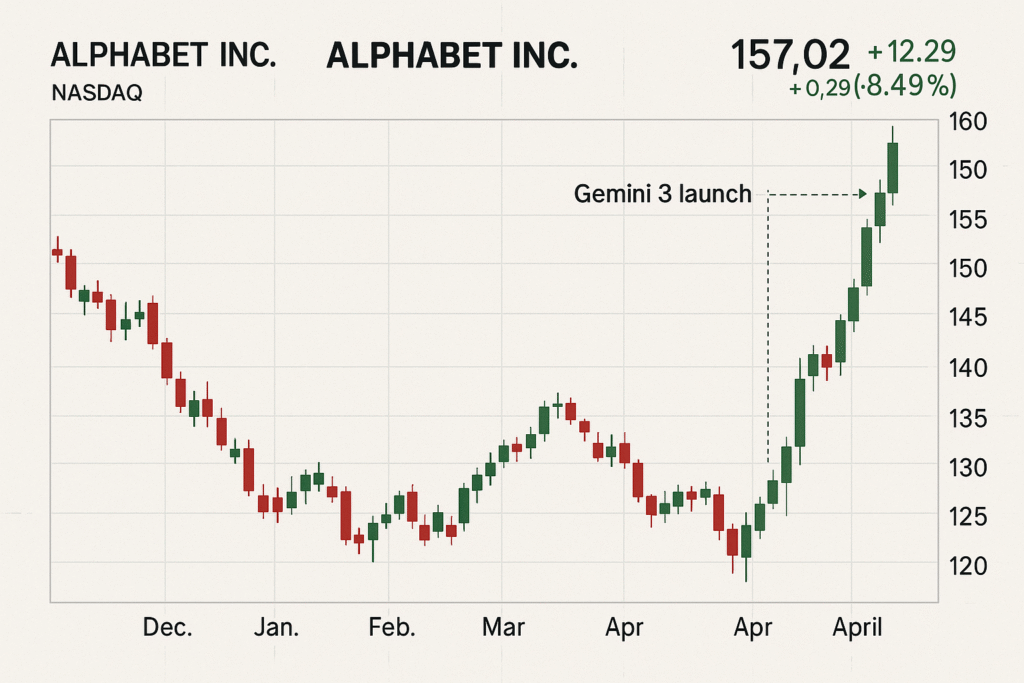

Alphabet shares soared Monday, climbing nearly 6% as Wall Street reacted to a wave of bullish sentiment surrounding Google’s newly launched Gemini 3 AI model. The tech giant crossed the $300 mark for the first time in its history, with both GOOGL and GOOG hitting intraday highs of $317.75. The rally marked Alphabet’s third record in a week and underscored the company’s rapid advance in the increasingly competitive artificial intelligence race.

Analysts say Gemini 3 is outperforming major rivals — including OpenAI and Anthropic — across speed, reasoning, and multimodal benchmarks. The model’s rollout on Nov. 18 sparked renewed enthusiasm for Alphabet’s AI roadmap, especially given that the company is now relying heavily on its own Tensor Processing Units (TPUs), reducing long-term reliance on Nvidia’s industry-leading GPUs.

Alphabet’s rise comes amid a mixed broader tech landscape, where concerns about overheating AI valuations have weighed on several megacap stocks. Still, Google’s results and product momentum appear to have bucked the broader trend.

Gemini 3 Strengthens Google’s Position in AI Leadership

Alphabet’s latest AI model, Gemini 3, is being widely praised as an inflection point in Google’s push to regain leadership in generative AI. Early reports show that Gemini 3 outperforms competing models on coding tasks, long-context comprehension, scientific reasoning, and multilingual capabilities.

The model has quickly expanded to 650 million monthly users, up sharply from 400 million earlier this year. Gemini-powered search and productivity tools are also seeing a significant jump in adoption. Generative AI’s share of web traffic driven by Google rose from 5.6% to 13.7% in a single year.

This rapid acceleration is crucial for Alphabet as the company tries to close competitive gaps opened by OpenAI’s ChatGPT and Anthropic’s Claude over the past two years.

Analysts raised price targets following Monday’s surge.

- BNP Paribas: $355

- Evercore ISI: $325

- Average forecast: $321.94

Alphabet now holds a market valuation above $3.6 trillion, the fastest-growing member of the Magnificent Seven in 2025.

Nvidia Slips as Investors Consider Google’s Custom Chips

Despite posting strong quarterly earnings, Nvidia fell 0.5% Monday, reflecting growing concerns that Google’s renewed chip independence may weigh on Nvidia’s long-term growth trajectory.

Alphabet’s TPU v6 and v7 units — the primary engines behind Gemini 3 — have significantly narrowed the performance gap with Nvidia’s H200 and upcoming B200 architectures. Google is now designing more of its own servers and inference hardware, contributing to shifts inside the AI supply chain.

While Nvidia remains dominant, analysts say hyperscalers such as Amazon, Microsoft, Meta, and now Alphabet are aggressively building custom silicon to reduce reliance on Nvidia’s premium GPUs.

Other AI-linked stocks saw mixed movements:

- AMD rose 3.8%

- Arista Networks gained more than 3%

- Microsoft remained flat

- Amazon added over 2%

The divergence shows early signs of competitive realignment as major tech firms reassess their AI infrastructure strategies.

Alphabet’s Financial Strength Underpins Investor Optimism

Alphabet is coming off one of its strongest financial runs in years. The company delivered four consecutive earnings beats and a 70% increase in share price over the past year. Q3 results were particularly strong:

- Pretax profit up 39%

- Operating margins expanded by seven percentage points

- Capital spending surged from $13B to $24B

Google Cloud remained a major engine of growth, with revenue jumping 34% year-over-year, outpacing both Microsoft Azure (33%) and Amazon AWS (20%). Cloud’s global market share has risen to 13%, compared with Azure at 20% and AWS at 29%.

Forecasts now project $75 billion in Google Cloud revenue by 2026.

Search also remains robust. Revenue from Google Search rose 15%, still accounting for more than half of Alphabet’s total revenue.

Major institutional investors are taking notice. Berkshire Hathaway recently disclosed a $4.34 billion investment in Alphabet, signaling long-term confidence in Google’s AI strategy.

GOOGL vs. GOOG: A Quick Breakdown for Investors

GOOGL and GOOG represent two share classes of Alphabet stock, both tied to the same economic interest:

- GOOGL (Class A): One vote per share

- GOOG (Class C): No voting rights

Both traded above $317 on Monday. Their valuations remain close, with price-to-earnings ratios around 31.3.

Looking Ahead

Analysts remain broadly bullish despite short-term overbought signals. Technical models suggest strong support around $290. Alphabet’s strong AI trajectory, expanding cloud presence, and growth drivers such as Waymo continue to position the company favorably heading into 2026.