By Harshit

WASHINGTON, JANUARY 12, 2026 —

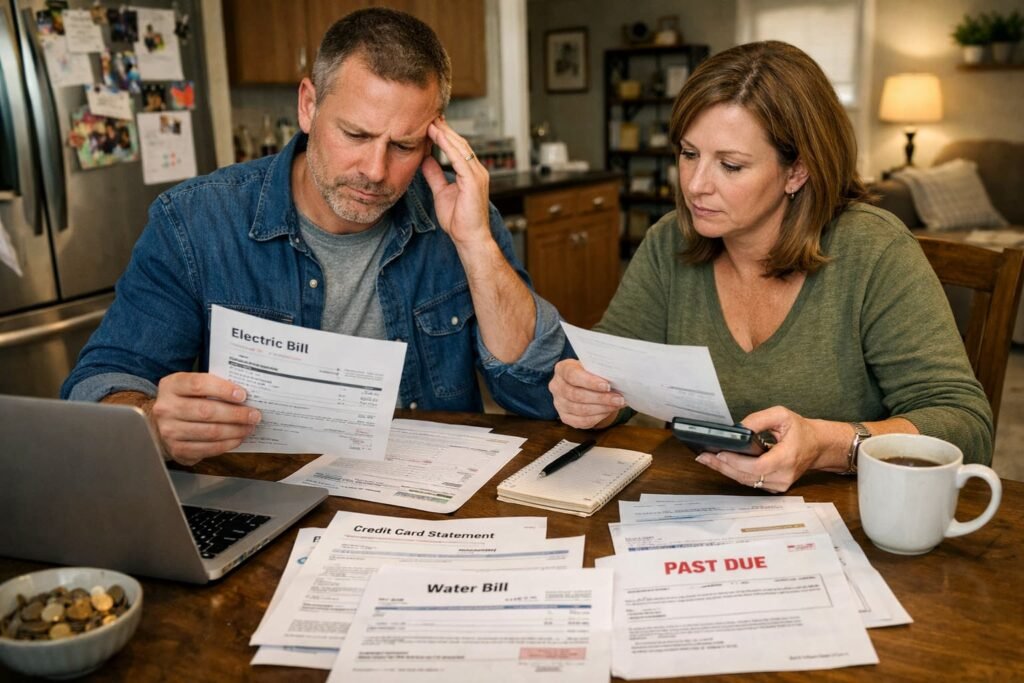

As the United States enters 2026, cost-of-living pressures continue to shape how Americans experience the economy, even as inflation remains lower than its earlier peaks. While headline inflation has moderated, prices for essential goods and services remain elevated compared with pre-pandemic levels, influencing household behavior, spending priorities, and overall economic sentiment.

Economists emphasize that the current environment is defined less by rapidly rising prices and more by the persistence of higher costs across key categories such as housing, healthcare, insurance, transportation, and education. This distinction explains why many households report ongoing financial strain despite stable employment conditions.

Prices Have Stabilized, Not Reversed

By early 2026, price growth across much of the economy has slowed. However, price levels themselves remain high. For households, this means that everyday expenses consume a larger share of income than they did several years ago.

Grocery prices, utility bills, and service costs have shown relative stability, but they remain well above earlier norms. As a result, purchasing power has not fully recovered for many Americans, particularly those with fixed or modest income growth.

Housing Continues to Dominate Household Budgets

Housing remains the single largest contributor to cost-of-living pressure. Rent growth has cooled in several regions, yet affordability challenges persist due to limited supply and the cumulative effect of prior increases. For homeowners, elevated mortgage rates and rising property-related costs continue to affect monthly expenses.

Housing’s outsized role means that even small changes in shelter costs have a disproportionate impact on household finances, limiting flexibility in other areas of spending.

Interest Rates and Household Decisions

Interest rates remain a key factor influencing household budgets in early 2026. Higher borrowing costs affect credit cards, auto loans, and other consumer credit, encouraging cautious financial behavior.

Rather than expanding consumption, many households prioritize debt reduction, emergency savings, and essential spending. Economists view this behavior as an adjustment to a higher-cost environment rather than a sign of economic distress.

Consumer Spending Reflects Caution, Not Contraction

Consumer spending remains active but selective. Americans continue to spend on necessities while exercising restraint on discretionary purchases. Price sensitivity remains high, with households responding strongly to promotions and value-based options.

Retailers and service providers have adapted by emphasizing affordability and targeted discounts, reflecting changing consumer priorities.

Broader Economic Implications

From a macroeconomic perspective, persistent cost-of-living pressure contributes to slower but more stable growth. While it limits rapid expansion, it also discourages excessive leverage and unsustainable spending patterns.

Outlook

As 2026 progresses, cost-of-living concerns are expected to remain central to economic decision-making. Even if inflation remains contained, elevated price levels will continue to influence how Americans budget, save, and spend.