By Harshit

NEW YORK, JANUARY 2, 2026

American businesses are entering 2026 with fewer illusions and sharper priorities. The era defined by post-pandemic stimulus, emergency fiscal support, and cheap capital is decisively over. In its place stands a leaner, more disciplined operating environment—one where execution, cost control, and measurable returns matter more than ambition or narrative.

As key provisions of the 2017 Tax Cuts and Jobs Act continue to phase out and the political urgency of late-2025 legislation fades, corporate leaders are waking up to what many describe as the Efficiency Economy. This is not a downturn. It is a recalibration—one that rewards operational agility over expansion and margin protection over market share.

For U.S. companies, 2026 is not about reinventing business models. It is about making existing ones work harder.

1. The Fiscal Reset: Operating After the Incentive Era

The most immediate change confronting corporate America in early 2026 is fiscal, not cyclical. While the statutory corporate tax rate remains unchanged, the effective tax burden for many firms has risen as accelerated write-offs and temporary incentives expire or narrow.

Capital Spending Gets More Disciplined

For much of the past decade, tax policy encouraged front-loaded investment. Immediate or near-immediate expensing made large capital purchases easier to justify. That math has changed.

In 2026, capital expenditures must once again clear longer payback horizons. Equipment, vehicles, and technology investments are increasingly evaluated through a multi-year cash-flow lens rather than short-term tax optimization.

As a result:

- CFOs are slowing discretionary capital spending

- Asset utilization is under closer scrutiny

- Leasing and asset-light strategies are gaining appeal

The rush to spend before year-end has been replaced by a deliberate reassessment of what investments truly improve productivity.

2. The Labor Market: The Middle-Skill Compression

At first glance, the U.S. labor market appears stable. Unemployment remains near the mid-4% range, layoffs are contained, and wage growth has moderated rather than collapsed. Beneath the surface, however, the composition of labor demand is shifting rapidly.

The Hollowing Middle

Demand in 2026 is strongest at the extremes:

- Physical and technical roles tied to infrastructure, healthcare, energy, and advanced manufacturing

- High-level strategic roles involving systems design, AI governance, and complex decision-making

What is shrinking is the middle layer—routine white-collar work that once supported large administrative and analytical teams. Roles involving repetitive reporting, basic financial modeling, simple coding, and transactional coordination are increasingly absorbed by automation.

The Quiet Workforce Reduction

Most companies are not announcing mass layoffs. Instead, they are practicing role attrition—allowing positions to disappear when employees leave. Hiring freezes are selective, not universal.

The result is a flatter organization with fewer managers, fewer layers, and higher expectations for remaining staff. The pressure is not dramatic, but it is persistent.

3. Supply Chains: De-Risking Becomes the Default

For years, supply-chain diversification was discussed as a contingency. In 2026, it is simply standard operating procedure.

Beyond ‘China Plus One’

Near-shoring efforts have matured—and in some cases, saturated. Industrial costs in popular relocation hubs have risen sharply, narrowing the initial advantage.

As a result, U.S. firms are extending diversification strategies further:

- Expanding supplier bases across multiple regions

- Accepting slightly higher costs in exchange for resilience

- Prioritizing predictability over lowest-price sourcing

Tariffs, meanwhile, have become a structural cost, not a temporary disruption. Companies are increasingly passing these costs through the supply chain, subtly reshaping product sizing, packaging, and pricing.

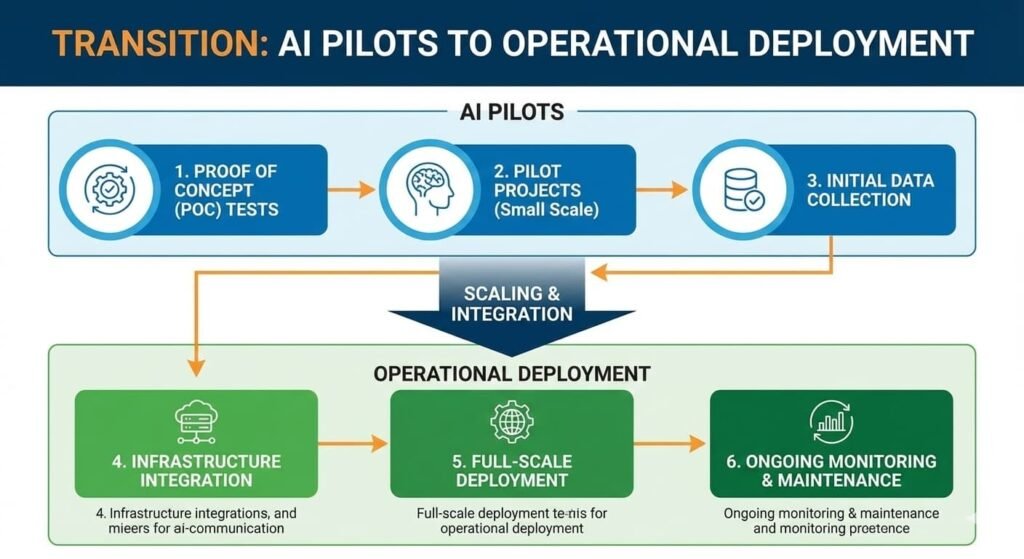

4. Technology: From Experimentation to Enforcement

The technology story of 2026 is not about innovation headlines—it is about enforcement. Artificial intelligence has moved from pilot programs into core operations, and leadership patience for vague promises has worn thin.

AI Must Pay for Itself

In 2024, AI projects were often justified by potential. In 2026, they are justified by outcomes.

Companies are deploying autonomous and semi-autonomous systems to:

- Handle internal reconciliations

- Streamline procurement and invoicing

- Reduce customer-service workload

- Monitor compliance and anomalies

What matters now is labor displacement at the margin, not wholesale replacement. The goal is to prevent headcount growth rather than trigger layoffs.

5. Corporate Culture: From Expression to Stability

One of the most under-discussed shifts entering 2026 is cultural. After several years in which companies actively engaged with social and political debates, many U.S. firms are stepping back.

The Rise of Corporate Neutrality

Executives are increasingly focused on:

- Reducing internal conflict

- Limiting reputational exposure

- Maintaining workforce cohesion

Human-resources leaders report that conflict management—not inspiration—is the most requested leadership skill entering the year. Employees are tired, not disengaged. Stability has become a benefit.

The emphasis is no longer on corporate voice, but on corporate reliability.

6. What the Efficiency Economy Rewards

The U.S. business environment in 2026 does not punish ambition—but it demands precision. Growth remains possible, but it must be earned through execution rather than leverage.

Successful firms will:

- Maintain strong balance sheets

- Use automation to protect margins

- Invest selectively, not broadly

- Retain and upskill critical talent

- Avoid unnecessary cultural and political risk

The common thread is professionalism. The shortcuts that once worked no longer do.

Conclusion: A Year for Operators, Not Storytellers

2026 will not be remembered for explosive growth or dramatic collapse. It will be remembered as the year American business returned to fundamentals.

The companies that succeed will not be the loudest or the fastest. They will be the most disciplined—those that understand that in the Efficiency Economy, every dollar, every hire, and every system must justify itself.

This is the Day One memo for the year ahead.