By Harshit

WASHINGTON, D.C., DECEMBER 14, 2025

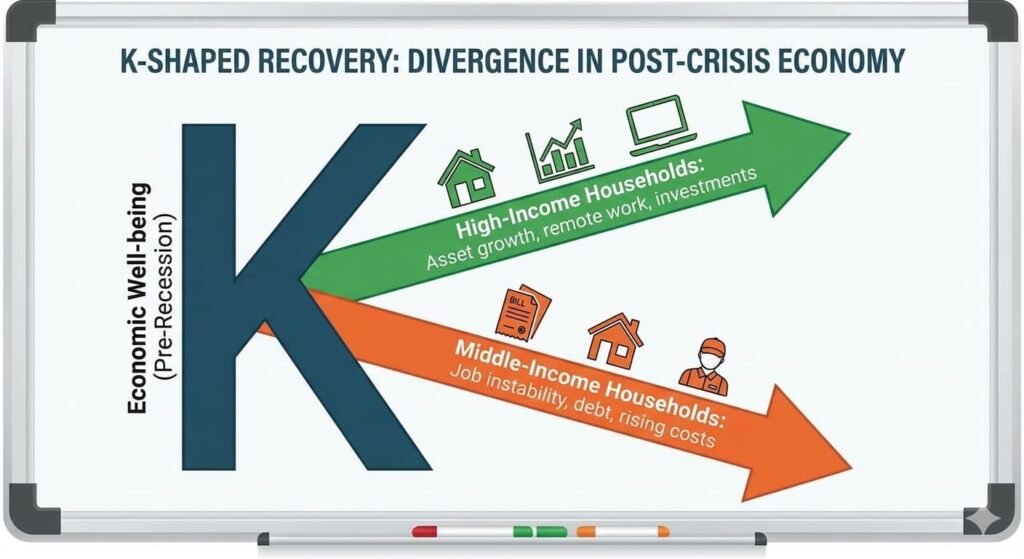

As the United States moves into 2026, the economic narrative has shifted away from the volatility of the pandemic era and the aggressive inflation battle that followed. The emerging landscape is shaped by a quieter but more persistent challenge—what economists increasingly call “Stagflation Lite.” This environment combines modest, below-trend economic growth with inflation that remains above the Federal Reserve’s target. Parallel to this, the country is entering a period of “K-Shaped” divergence, in which economic outcomes for high-income households and the middle class are moving in starkly different directions.

This paired dynamic forms the structural foundation of the coming year, redefining how American households must think about income, investment, and long-term financial resilience.

Growth Slows as Inflation Stays Sticky

Economic forecasts for 2026 indicate that the U.S. is settling into a lower-growth environment even as inflation cools more gradually than policymakers had hoped. Private-sector estimates place real GDP growth between 1.8% and 2.3%, slightly below the long-term trend. This comes after a volatile 2025 marked by uneven quarterly performance and consumer spending split across income groups.

Inflation, particularly the Core PCE index, is projected to end 2026 in the 2.5% to 2.8% range. These levels are significantly lower than during the peak inflation periods of 2022–2023 but remain above the Federal Reserve’s 2% objective. The persistence of services inflation—especially in housing, healthcare, and insurance—remains the primary barrier to a clean return to price stability.

This combination of below-trend growth and above-target inflation forms the essence of Stagflation Lite. It is not a 1970s-style economic crisis, but it does represent a chronic erosion of purchasing power that most sharply impacts middle-income households.

A New Interest-Rate Regime

After a series of cuts in late 2025, the Federal Reserve brought the federal funds rate into a 3.50%–3.75% range. Rate cuts are now expected to proceed gradually, with the Fed’s December projections showing only one additional quarter-point cut in 2026. This marks a new monetary normal: borrowing costs will remain structurally higher than in the 2010–2021 era of near-zero rates.

The labor market continues to cool but remains stable, with unemployment at 4.4% heading into the new year. A shrinking labor force—driven by accelerated Baby Boomer retirements and limited immigration growth—has reduced the risk of a sharp rise in joblessness. This dynamic supports wage growth but also reinforces services inflation, complicating the Fed’s task.

The K-Shaped Economy Widens

One of the defining features of the 2026 outlook is the widening gap between the economic fortunes of higher-income Americans and the rest of the population. Wealthier households, buoyed by strong equity market gains in 2024 and 2025 and by rising returns on interest-bearing assets, continue to spend at robust levels. Their consumption of travel, luxury goods, and premium services is sustaining segments of GDP.

Middle-income households, in contrast, face the heaviest pressure from Stagflation Lite. Elevated prices for housing, childcare, insurance, and credit card interest mean real wages are struggling to keep pace with expenses. For these households, financial fragility remains a central theme heading into 2026.

Several structural forces are driving this divergence:

- Housing affordability remains constrained, with limited supply keeping home prices high and mortgage rates still well above pre-2022 norms.

- Tariffs and global trade tensions continue to raise goods prices, preventing core goods inflation from easing quickly.

- Demographic pressures reduce labor supply, keeping wage-driven inflation in services elevated.

Together, these trends reinforce the socioeconomic split that defines the K-shaped recovery.

Strategies for Households in 2026

For American families, navigating the New Normal means emphasizing stability, income generation, and AI-complementary skill development.

Fixed Income Returns Are Attractive Again

With treasury yields stabilizing and interest rates still elevated, high-quality bonds offer meaningful returns for the first time in nearly two decades. Investors prioritizing income and risk management will likely benefit from overweighting intermediate-term treasuries and diversified fixed-income portfolios.

AI-Resilient Skills Are the New Job Security

While widespread displacement from AI remains limited in 2026, the technology is transforming business investment. Professions that rely on judgment, synthesis, ethical oversight, and advanced analytical skills are seeing rising wage premiums. Workers who align with AI-complementary roles will be better positioned in the evolving labor market.

Financial Resilience Takes Priority

Amid high borrowing costs, eliminating high-interest debt is essential. Real assets—such as income-producing real estate or high-quality equities—remain more effective long-term hedges against inflation than holding excess cash.

Conclusion: A Decade Defined by Divergence

The United States is entering a period where structural forces matter more than cyclical ones. Stagflation Lite will test household budgets, and the widening K-shaped economy will continue to challenge policymakers. The key question for the late 2020s is whether fiscal policy, housing reform, and productivity gains—especially from AI—can ease the pressure on the middle class.

For consumers, clarity and preparation are essential. The path forward requires understanding structural economic pressures and prioritizing both financial resilience and skill-based adaptability.