By Harshit, Global Trends Analyst, TodayInUSAndWorld.com

December 12, 2025

Access to capital remains the single greatest challenge facing U.S. small businesses heading into 2026. Interest-rate uncertainty, tighter traditional lending standards, and heightened competition for grants have made the funding landscape more complex—yet the core pathways available to small firms remain consistent and reliable.

This guide explains the four foundational capital categories every entrepreneur must understand to secure the right financing at the right time.

Pathway 1: The Government-Backed Safety Net (SBA Loans)

The Small Business Administration (SBA) does not directly lend money (except in limited disaster-related programs). Instead, it guarantees a portion of loans made by banks, credit unions, and approved lenders. This government guarantee reduces risk for lenders and typically provides borrowers with better rates, longer repayment terms, and more flexible qualifications than conventional loans.

Key SBA Loan Types for 2026

| SBA Loan | Best For | Key Fact |

|---|---|---|

| SBA 7(a) | Working capital, equipment, business acquisition, partner buyouts | Most flexible SBA program; loans up to $5 million |

| SBA 504 | Commercial real estate, machinery, heavy equipment | Long-term fixed-rate financing via SBA + Certified Development Company |

| SBA Microloan | Small start-ups & early-stage businesses | Up to $50,000; includes required technical assistance |

Harshit’s Global Trend Insight

Tighter bank underwriting conditions in 2024–2025 have made SBA-backed financing the most accessible and affordable capital in 2026 for creditworthy businesses. SBA loans are the preferred first option for any business with verifiable cash flow and a clear use of funds.

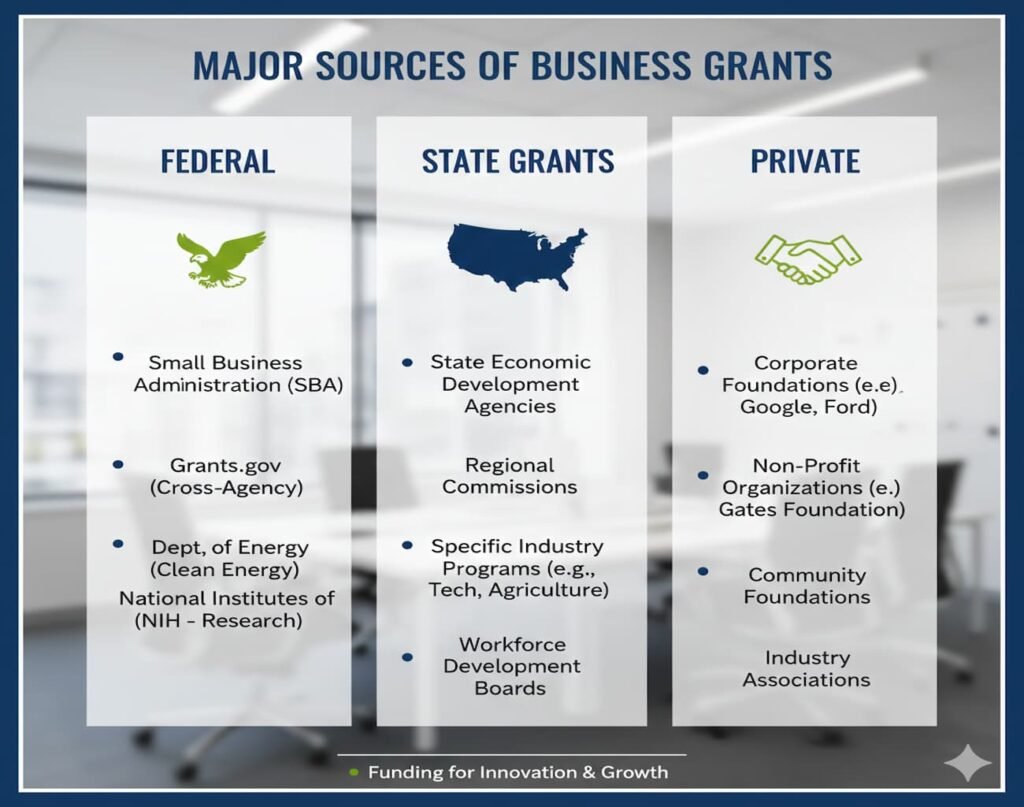

Pathway 2: Free Money, High Competition (Grants)

Grants are the most attractive form of capital because they do not require repayment. However, they are highly competitive, mission-specific, and application-heavy.

Types of Small-Business Grants

1. Federal Grants

- SBIR/STTR for science, defense, and high-innovation research

- USDA Rural Development for rural business programs

- Select commerce or infrastructure grants through EDA and Grants.gov

Note: The SBA rarely offers grants except for community organizations, not typical small businesses.

2. State & Local Grants

- Workforce training programs

- Local development authority grants

- City-level innovation and accelerator funds

These programs often have lower competition than federal grants.

3. Private & Diversity Grants

- Amber Grant Foundation (women-owned businesses)

- MBDA (minority-owned business support)

- Corporate grants from Amazon, Visa, Wells Fargo, and regional foundations

Actionable Advice

Never pay a third party to “secure” a grant for you.

Most legitimate grants are free to apply for and list clear eligibility requirements.

Pathway 3: Quick Capital for Cash Flow (Alternative Financing)

When speed matters—or when a business cannot qualify for bank or SBA financing—alternative capital can fill the gap. The tradeoff: cost.

| Financing Type | Best For | Watch Out For |

|---|---|---|

| Business Line of Credit | Seasonal cash flow, unplanned expenses | Higher APR than bank loans; variable rates |

| Invoice Factoring / Financing | B2B companies with slow-paying customers | Factor fees reduce profit margins |

| Equipment Financing | Vehicles, machinery, tools, office systems | Equipment is collateral—cannot be used for other costs |

| Crowdfunding | Product validation & early customer acquisition | Requires substantial marketing and audience engagement |

Harshit’s Global Trend Insight

Fintech lenders (OnDeck, Fundbox, BlueVine) have revolutionized application speed, but their APR can exceed traditional bank rates by a wide margin. Borrowers must compare the true cost difference between alternative capital and SBA financing before committing.

Pathway 4: High-Growth Capital (Venture Capital & Angel Investors)

Equity financing is appropriate only for businesses with scalable growth potential, not for typical local service firms.

Angel Investors

- Invest personal funds

- Typical checks: $25k–$250k

- Often provide strategic mentorship

- Suitable for prototype-stage or early revenue companies

Venture Capital (VC)

- Invest institutional funds

- Focused on fast-scaling companies (tech, biotech, AI, SaaS)

- Expect significant equity in return

- Require board seats and high-growth projections

The Trade-Off

Equity investors fuel growth but dilute ownership.

A founder must weigh control vs. scale.

Analyst’s Takeaway: Choosing the Right Path

Before pursuing any funding source, entrepreneurs should apply the Harshit Rule of Three:

1. Know Your “Why”

Funding must be tied to a specific business objective

(e.g., buying a CNC machine, expanding a warehouse, scaling a marketing program).

2. Know Your Numbers

Have:

- A complete business plan

- Historical financial statements (if applicable)

- 12–36 month projections

- Cash flow analysis

3. Know Your Credit

Personal and business credit scores drive approval odds and interest rates.

Even SBA and alternative lenders evaluate the owner’s personal credit profile.

Final Outlook for 2026

As economic conditions evolve, small businesses that understand these four funding pathways—and approach lenders and investors with strategic clarity—will secure capital more efficiently than those who simply search for “funding.”

The most successful entrepreneurs in 2026 will not be the ones chasing money.

They will be the ones choosing the right type of capital for the right stage of growth.