By Harshit

NEW YORK, Dec. 4 —

Meta Platforms (NASDAQ: META) received a fresh wave of bullish sentiment on Thursday after Arete upgraded the social networking giant from “neutral” to “buy,” citing stronger long-term revenue visibility, accelerating engagement across Meta’s app ecosystem, and expanding operating margins tied to AI-driven advertising improvements. Arete assigned a $718 price target, representing a 12.26% upside from Meta’s previous close, signaling growing confidence among Wall Street analysts that the company’s business fundamentals remain robust amid a volatile large-cap tech environment.

The upgrade comes during a period of heightened competition among mega-cap technology names, with investor attention increasingly concentrated on companies demonstrating strong AI monetization strategies. Meta’s continued investment in generative AI and infrastructure expansion has positioned the company as a top contender in what analysts refer to as the “Big-Upside Tech Cycle.”

Analyst Sentiment Remains Strong Across Wall Street

Meta continues to command one of the most favorable analyst ratings profiles in large-cap tech. In addition to Arete’s upgrade, several major firms issued updated commentary:

- Jefferies Financial Group lowered its price target from $950 to $910, maintaining a “buy” rating.

- Wells Fargo & Company cut its target from $837 to $802, retaining an “overweight” stance.

- UBS Group raised its price objective from $900 to $915, reiterating a “buy.”

- Needham & Company restated a “hold” rating.

- Rosenblatt Securities boosted its target from $1,086 to $1,117, maintaining a “buy.”

Overall, Meta now holds 4 Strong Buy, 39 Buy, and 8 Hold ratings, giving it a consensus recommendation of “Moderate Buy” with an average analyst target of $819.43, according to MarketBeat.

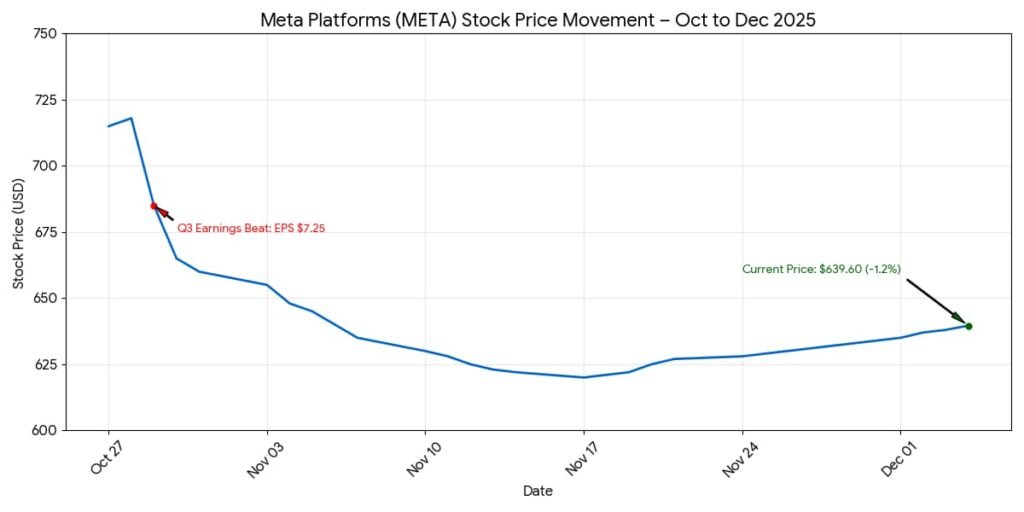

Meta Shares Trade Lower Despite Upgrade

Shares of META opened at $639.60, down 1.2% on Thursday as broader market weakness weighed on tech equities despite the favorable analyst coverage. Even with the decline, Meta retains a strong financial posture:

- Market cap: $1.61 trillion

- P/E ratio: 28.25

- PEG ratio: 1.36

- Beta: 1.28

- Quick ratio: 1.98

- Debt-to-equity: 0.15

The stock’s 50-day moving average sits at $676.31, while the 200-day average stands at $706.12, indicating that Meta remains below its medium-term trendlines. The company has traded between $479.80 and $796.25 over the past year.

Earnings Beat Reinforces Meta’s AI-Driven Growth Story

Meta last reported earnings on October 29, posting:

- EPS: $7.25 (vs. $6.74 expected)

- Revenue: $51.24 billion (vs. $49.34 billion expected)

- Net margin: 30.89%

- Return on equity: 39.35%

This represents a 26.2% year-over-year revenue increase, driven by stronger ad spending, Instagram Reels monetization gains, and early contributions from Meta’s new AI-powered ad tools.

Analysts project full-year EPS of 26.7, underscoring Meta’s improved operating efficiency as AI workloads shift more tasks to automated systems.

Insider Activity: Top Executives Sell Shares

Insider activity has drawn attention following two notable transactions:

- COO Javier Olivan sold 2,610 shares at an average of $609.46, totaling $1.59 million, reducing his holdings by approximately 21%.

- Director Robert M. Kimmitt sold 600 shares at $609.35, valued at $365,610, decreasing his position by 7.55%.

In the last 90 days, insiders have sold 41,440 shares valued at $26.34 million. Insiders collectively own 13.61% of Meta’s outstanding shares.

Institutional Investors Continue Expanding Their Positions

Institutional ownership remains a key stabilizing factor for Meta, with 79.91% of shares held by institutions and hedge funds. Recent movements include:

- Westchester Capital Management — new position

- Bare Financial Services — new stake

- Evergreen Private Wealth — increased holdings by 237.5%

- Briaud Financial Planning — new stake

- Knuff & Co — new stake

Strong institutional confidence generally signals long-term bullish momentum, even amid market volatility.

Company Profile: Meta Platforms

Meta Platforms, Inc. develops products enabling global communication and social connectivity across mobile devices, PCs, VR headsets, and wearables. Its two core segments include:

Family of Apps

- Messenger

Reality Labs

Meta’s long-term bet on AR/VR and immersive computing.