By Harshit

SAN FRANCISCO, NOVEMBER 22, 2025

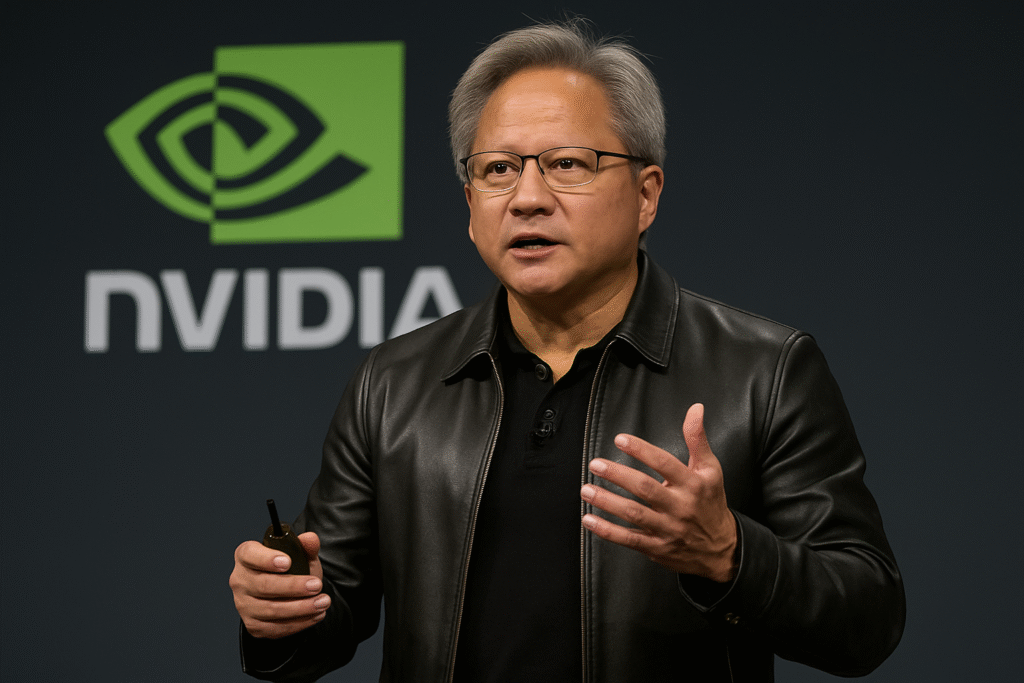

Despite delivering one of the strongest earnings reports in Silicon Valley this year, Nvidia is still struggling to calm rising concerns that the artificial intelligence boom may not be as stable as it looks. On Wednesday, the chipmaker reported year-over-year sales and profit growth above 60%, beating Wall Street expectations yet again — a performance CEO Jensen Huang described as “off the charts.” But instead of rallying behind the news, investors sent the stock down 1% by Friday.

The response illustrates a paradox: Nvidia remains the undisputed titan of AI hardware, but doubts about a broader market bubble continue to shadow its meteoric rise.

Nvidia Posts Monster Results — But Skepticism Persists

Nvidia’s latest quarterly revenue projection — around $65 billion for Q4 — once again came in ahead of analyst estimates. CFO Colette Kress highlighted an expected $3 trillion to $4 trillion annual AI infrastructure market by the end of the decade, driven by cloud providers, hyperscalers, and enterprise demand.

Yet the stock barely budged.

After nearly two years of explosive growth, Nvidia’s valuation has soared into territory analysts describe as “historically demanding.” Even small hints of uncertainty now trigger questions about whether expectations have run too far ahead of reality.

“There’s been a lot of talk of an AI bubble,” Huang acknowledged during Wednesday’s analyst call. “From our vantage point, we see something very different.”

Some analysts agree. Wedbush’s Dan Ives called Nvidia’s guidance proof that “the AI revolution is NOT a bubble,” characterizing the current phase as “Year 3 of a 10-year build-out.”

But the broader market remains cautious — signaling that Nvidia’s spectacular quarter was not enough to flip the narrative.

Why Investors Aren’t Convinced

1. Heavy Dependence on Massive AI Infrastructure Spending

Nvidia’s growth is tied tightly to how much companies like OpenAI, Meta, Microsoft, Amazon, and Google are willing to spend on data centers and GPU clusters. That spending is enormous this year — estimated at $400 billion — but investors are unsure whether these levels can be sustained.

Tech giants themselves have yet to prove profitable business models for generative AI. Cloud bills are rising faster than revenue for many AI companies.

2. Nvidia’s “Circular Funding Loop” Raises Questions

A growing concern on Wall Street is Nvidia’s pattern of:

- investing in AI startups like OpenAI and Anthropic

- which then use that funding to buy Nvidia GPUs

- pushing Nvidia’s revenue even higher

Some analysts warn that this cycle resembles the speculative dynamics seen in previous tech bubbles — where inflated expectations artificially boost demand.

Synovus Trust’s Daniel Morgan said Nvidia’s flashy report “did not put to rest” these concerns.

3. Fears Sparked by OpenAI’s Warning on Debt

Earlier this month, OpenAI CFO Sarah Friar said U.S. government backstops might be needed to support the massive debt tech companies are taking on to build AI infrastructure.

Many investors interpreted this as a red flag, worrying that even top AI firms may be stretched thin — and therefore may not sustain current purchasing levels.

OpenAI later tried to soften the statement, but the concern lingered.

Why Some Analysts Believe There Is No Bubble

Despite the anxiety, several analysts remain bullish:

- Morningstar’s Brian Colello sees “no signs” that 2026 will be a weak year for Nvidia.

- Nvidia continues to dominate enterprise software acceleration, not just generative AI.

- Meta, Salesforce, and Anthropic all described major productivity or revenue increases tied to Nvidia-powered AI tools.

Moreover, the world’s legacy software infrastructure — data processing, simulation, cloud workloads — is steadily shifting from CPUs to GPUs, providing Nvidia multiple avenues for growth even if generative AI cools.

“The world has a massive investment in non-AI software,” Huang said. “These transitions alone will drive significant demand.”

Bubble or Boom? The Debate Continues

Nvidia’s earnings may have validated the company’s current dominance, but they did not resolve the deeper question haunting the market: Is the AI explosion sustainable?

Analysts say Nvidia itself will probably remain strong regardless of a downturn, thanks to its central role in cloud computing. But the broader AI sector — from small startups to giant models with uncertain revenue — may not withstand a slowdown.

For now, Nvidia’s breathtaking numbers have pushed the bubble debate into the next quarter. The company will need more than blowout earnings to convince markets that AI’s future is boom, not bust.