By Harshit

NEW YORK, Nov. 21, 2025

U.S. Treasury yields fell on Friday after New York Federal Reserve President John Williams said the central bank may have room to lower interest rates again at its final policy meeting of the year, offering investors fresh hope of another cut at a time when markets have grown increasingly cautious about the rate outlook.

Williams, speaking in Santiago, Chile, said the Federal Reserve’s policy stance has become “somewhat less restrictive” following two consecutive quarter-point rate cuts in September and October. He indicated that another adjustment may be warranted to keep monetary policy aligned with the Fed’s dual mandate.

“I still see room for further adjustment in the near term to the target range for the federal funds rate,” Williams said, emphasizing the Fed’s goal of maintaining balance between stable prices and maximum employment. His comments immediately shifted investor sentiment in the bond market, pushing yields lower across the curve.

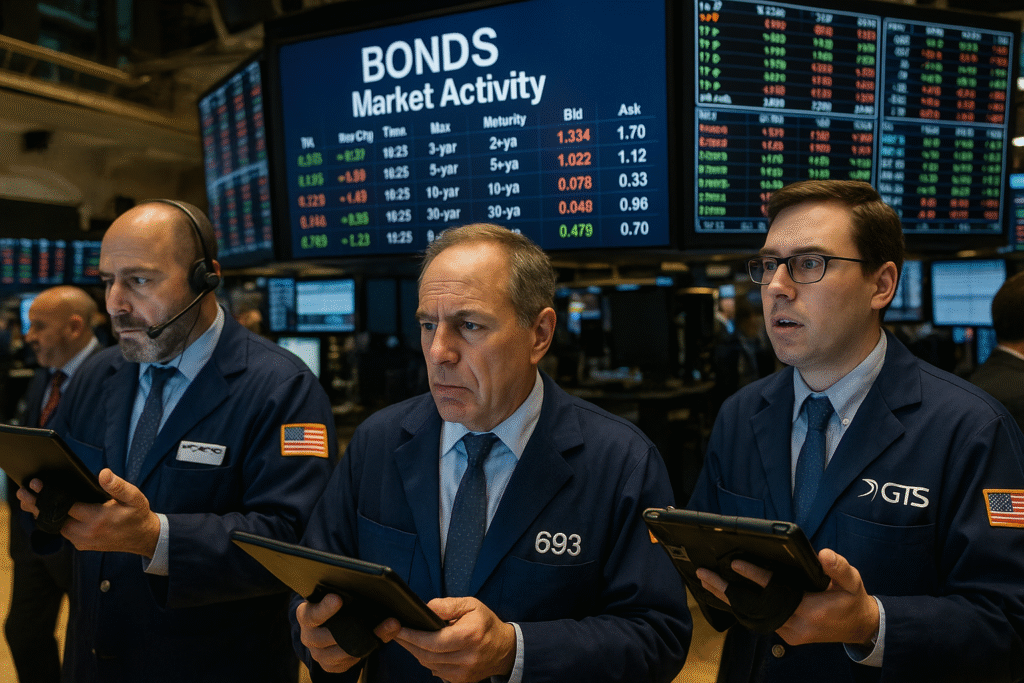

Yields Move Lower Across the Curve

Following Williams’ remarks, the yield on the benchmark 10-year Treasury fell more than 4 basis points, sliding to around 4.06%. The 2-year note yield dropped more than 5 basis points to roughly 3.50%, and the longer-term 30-year Treasury yield slipped more than 2 basis points to about 4.71%.

A basis point equals 0.01%, and yields move inversely to price.

The decline marked a reversal from recent sessions, where yields had risen sharply amid speculation that the Fed could pause its rate-cutting cycle due to persistent inflation risks. Instead, Williams’ tone revived hopes that another 25-basis-point cut remains on the table.

Market Expectations Shift Toward a December Cut

Fed funds futures traders quickly recalibrated their expectations following Williams’ speech. According to CME Group’s FedWatch tool, markets began pricing in a more than 70% chance of a December rate cut — a significant jump from less than 40% just one day earlier.

Williams’ comments came at a pivotal moment. In recent weeks, several Fed officials, including Boston Fed President Susan Collins, had argued that the bar for additional easing was high. Others, such as Governor Christopher Waller and Governor Stephen Miran, have expressed greater concern about weakening labor market conditions.

Williams did not commit definitively to a December cut but indicated that the economy has moved closer to a “neutral” policy stance, suggesting that there may be room to prevent further labor market softening without reigniting inflation.

Labor Market Concerns Gain Urgency

Investors are still digesting Thursday’s delayed nonfarm payrolls report — the first major release published after the 43-day government shutdown ended last week. The report showed that the U.S. economy added more jobs than expected in September, reflecting underlying labor demand. However, the unemployment rate rose to 4.4%, the highest level since October 2021.

The mixed signals have intensified a policy debate inside the Fed. While strong job creation implies economic resilience, the rising unemployment rate points to softening conditions beneath the surface. Williams acknowledged this complexity, but said risks now appear “more balanced,” with inflation showing signs of easing and labor market pressures becoming more evident.

Investor Reaction: Relief but Ongoing Caution

Treasury yields were already on the decline Friday morning after a sharp sell-off in U.S. equities on Thursday. Big-cap technology stocks had come under renewed pressure as investors reassessed expensive AI-related valuations, putting broader market sentiment on edge.

Williams’ remarks added a layer of optimism, calming bond markets and lending some stability to trading heading into the weekend. Still, investors remain cautious, given the volatile backdrop and the weight of delayed economic data now set to be released in the coming days.

Economists are watching closely to see whether the Fed will follow through with another cut on December 10 — a move that would mark its third consecutive reduction as policymakers try to avoid a deeper labor market downturn while ensuring inflation stays on track toward the central bank’s 2% target.