By Harshit

WASHINGTON, D.C., NOV. 19 —

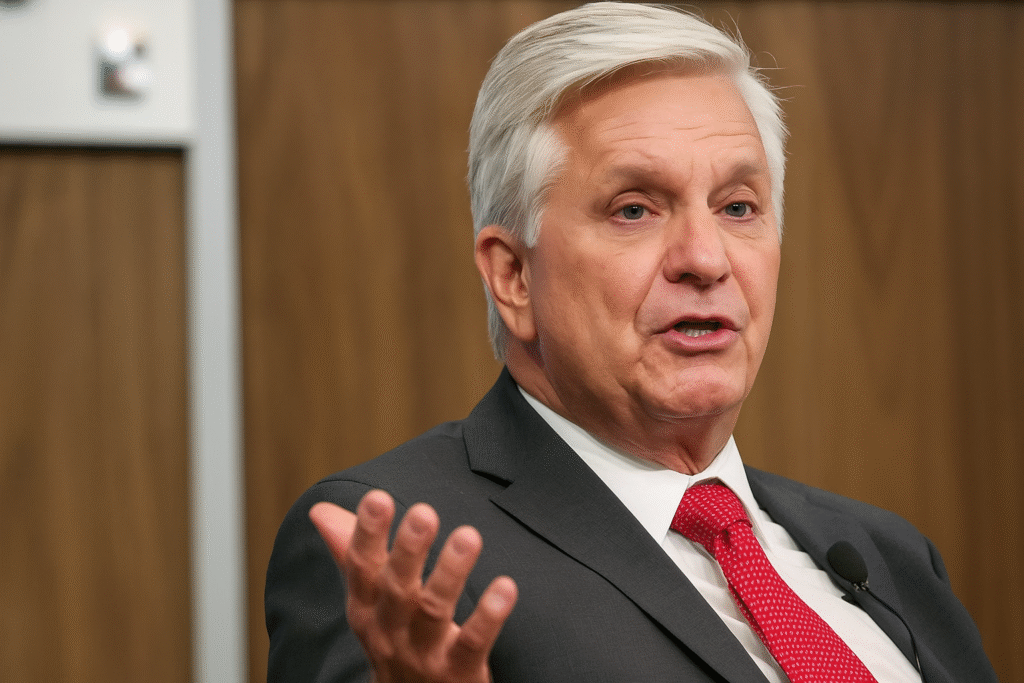

Federal Reserve Governor Christopher Waller on Monday signaled clear support for another interest rate cut at the central bank’s December 9–10 meeting, warning that months of weakening labor market data and a sharp slowdown in hiring now pose a greater risk to the U.S. economy than inflation.

Waller’s remarks, delivered to a group of economists in London, place him firmly among the Fed officials pushing for a third consecutive rate cut, following quarter-point reductions in September and October. His position stands in contrast to several regional Fed presidents who have argued in recent days that further easing could reignite inflationary pressures.

Waller: Inflation Not the Threat — Jobs Are

In his prepared remarks, Waller made it clear that he does not view inflation as the obstacle it was in 2022 and 2023.

“I am not worried about inflation accelerating or inflation expectations rising significantly,” Waller said. “My focus is on the labor market, and after months of weakening, it is unlikely that the September jobs report later this week or any other data in the next few weeks would change my view that another cut is in order.”

Waller’s comments underscore a significant shift within the Federal Open Market Committee (FOMC): the belief that the Fed’s restrictive monetary policy may now be exerting too much pressure on lower- and middle-income households, even as inflation continues to moderate.

The upcoming September nonfarm payrolls report, set for release later this week after delays caused by the historic government shutdown, is not expected to change Waller’s stance.

A Divided Federal Reserve Ahead of the December Meeting

The Fed is increasingly split over how to proceed. While Waller and some governors want to ease policy further, others are urging restraint:

- Fed Vice Chair Philip Jefferson said Monday that policymakers must “proceed slowly,” without committing to a December cut.

- Boston Fed President Susan Collins said last week she sees a “high bar” for more easing.

- Governor Stephen Miran, also appointed by President Donald Trump, has favored larger half-point cuts in earlier meetings.

Financial markets reflect the divide as well: investors remain split on whether the FOMC will deliver another 25-basis-point cut or remain on hold in December.

Waller Calls It ‘Risk Management’

Highlighting consumer strain and slowing hiring, Waller said the Fed needs to act preemptively.

“I worry that restrictive monetary policy is weighing on the economy, especially about how it is affecting lower- and middle-income consumers,” Waller said. “A December cut will provide additional insurance against an acceleration in the weakening of the labor market and move policy toward a more neutral setting.”

His remarks echo comments from Fed Chair Jerome Powell, who has repeatedly framed the current policy approach as “risk management” — balancing the dangers of overtightening against the risks of easing too late.

Waller also noted that while government data was largely suspended during the 43-day federal shutdown, the Fed has leveraged private-sector and partial public-sector datasets to track economic conditions.

“Despite the government shutdown, we have a wealth of private and some public-sector data that provide an imperfect but perfectly actionable picture of the U.S. economy,” he said.

Tariffs Not Driving Inflation, Waller Says

Addressing one of the biggest policy debates of 2025 — whether President Donald Trump’s renewed tariffs could spark another inflation wave — Waller said the evidence suggests otherwise.

He argued that price data indicates tariff impacts will be temporary, giving the Fed more freedom to ease without risking a sudden inflation rebound. This point directly counters some regional presidents who have warned that tariff-driven price pressures could force the Fed to keep rates elevated.

A Labor Market Losing Momentum

Although official data releases were frozen during the shutdown, alternative indicators show:

- a meaningful slowdown in job creation,

- rising signs of softening demand for labor, and

- increased pressure on consumer spending.

Waller warned that waiting too long risks allowing conditions to deteriorate further.

“After months of weakening,” he said, “the labor market needs support.”

His stance suggests he believes the Fed should act now to prevent broader economic damage rather than wait for more definitive government data.

What Comes Next

All eyes will now turn to:

- the delayed September jobs report,

- the release of FOMC minutes later this week, and

- several important data points postponed by the shutdown.

With inflation cooling and hiring slowing, the December FOMC meeting is shaping up to be one of the most contentious in years.