By Harshit

WASHINGTON, November 18, 2025 — 10:45 PM EST

Novo Nordisk, the maker of Wegovy and Ozempic, announced significant price cuts Monday for cash-paying customers — a move that reflects rising competitive pressure in the GLP-1 weight-loss market and direct intervention from the Trump administration.

The reductions mark the latest effort by major drugmakers to maintain dominance in a booming industry increasingly threatened by compounding pharmacies, Eli Lilly’s expanding GLP-1 portfolio, and the White House’s push for lower prices ahead of the launch of TrumpRx, a government-backed direct-to-consumer (DTC) pharmacy platform scheduled for early 2026.

Lower Prices for Direct-Pay Patients

Under the new pricing structure, Novo Nordisk is offering the first two monthly doses of Wegovy and Ozempic for $199, available through its DTC channels and more than 70,000 participating pharmacies. These discounts apply to the two lowest starter doses and expire March 31, 2026.

For all other self-pay customers, Novo Nordisk is reducing prices to:

- $349/month for most doses of Wegovy and Ozempic (previously $499)

- $499/month for the highest 2mg dose of Ozempic (unchanged)

The new prices bring Novo Nordisk closer to the low-cost offerings from compounding pharmacies and align more closely with Eli Lilly’s direct pricing for Zepbound — which currently costs $349 for starter doses and $499 for higher doses.

“There’s a lot of interest in direct pay,” said Dave Moore, executive vice president of U.S. operations. “We know that’s an interest of people living with obesity.”

Why Novo Nordisk Is Cutting Prices Now

Industry analysts say the decision is driven by three major pressures:

1. Presidential Pressure and TrumpRx

Last month, President Donald Trump announced a sweeping agreement with Novo Nordisk and Eli Lilly that will bring GLP-1 drugs to Medicare and Medicaid at far lower prices starting mid-2026.

Under the agreement:

- Direct-to-consumer injectable GLP-1 medications will start at $350/month

- Prices will gradually fall to about $250/month over two years

- Oral GLP-1 tablets — once approved — will cost as little as $149 for the lowest dose

These prices will be integrated into TrumpRx, the administration’s DTC online marketplace that aims to undercut pharmacy list prices and bypass insurers.

2. Eli Lilly’s Market Expansion

Eli Lilly’s Zepbound and Mounjaro continue to surge in demand. Analysts say Novo Nordisk’s U.S. market share has shown signs of softening, prompting the company to respond aggressively.

“Reduced self-pay pricing reflects a reaction to Novo’s softening market share,” wrote Evan Seigerman, pharmaceutical analyst at BMO Capital Markets.

3. Compounding Pharmacies Challenging Brand Dominance

Compounding pharmacies have been offering semaglutide and tirzepatide blends at far lower prices — often $200–$350/month — and are capturing a meaningful slice of the DTC weight-loss market.

By lowering its own DTC price to $199, Novo Nordisk is directly targeting this increasingly disruptive sector.

Demand for GLP-1s Remains Exceptionally High

According to a new KFF Health Tracking Poll:

- 1 in 8 U.S. adults is currently taking a GLP-1 drug

- About 25% of users with insurance still pay the full price out of pocket

- Cost remains the #1 reason people stop taking the medications

Insurance coverage is uneven:

- Ozempic is widely covered for diabetes

- Wegovy is spottily covered for obesity treatment due to its high list price

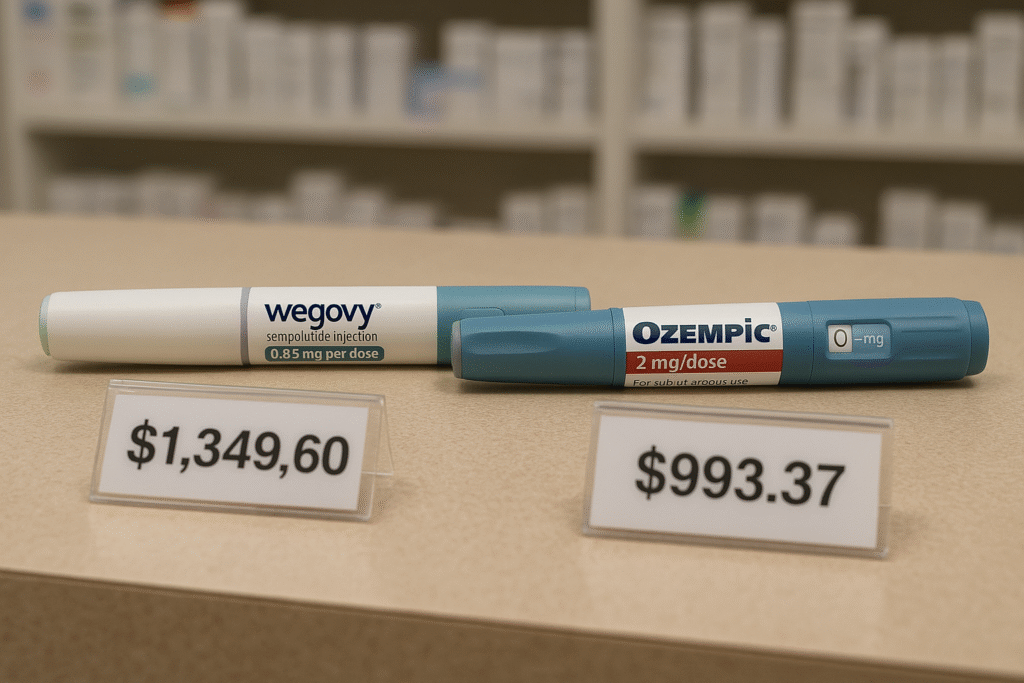

Wegovy’s list price is $1,349 per month, though insured patients often pay less. With coverage inconsistent, many middle-income Americans turn to cash-pay options, making Novo Nordisk’s new price cuts strategically vital.

Novo’s Global Strategy: Control the DTC Space Before Rivals Do

Novo Nordisk launched its own direct-to-consumer pharmacy earlier this year to recapture consumers who might otherwise go to telehealth startups or compounders. The company now offers:

- Wegovy for $349–$499/month (dose-dependent)

- Ozempic at half price — $499/month — for cash-pay customers

The new $199 starter price is expected to rapidly increase subscription volume, particularly for those seeking short-term access before insurance approval.

The cash-pay market currently represents about 10% of all Wegovy prescriptions, and Novo Nordisk expects that figure to grow sharply heading into 2026, especially as TrumpRx comes online.

A Crowded and Intensifying Weight-Loss Market

The GLP-1 boom is reshaping nearly every part of the U.S. wellness and medical ecosystem:

- Weight Watchers, Costco, and GoodRx have partnered with manufacturers

- Employers face ballooning costs as millions seek coverage

- Telehealth clinics are racing to provide cheaper access

- Biotech companies are developing next-generation GLP-1s and oral versions

With prices dropping and new government platforms emerging, analysts expect the market to expand from 15 million U.S. users in 2025 to over 30 million by 2028.

But affordability remains a core concern. Experts warn that even with discounted prices, the drugs may remain financially out of reach for many Americans without insurance coverage — particularly because GLP-1 therapy requires long-term or lifelong use to maintain weight loss.