By Harshit

New York, USA | November 14, 2025 | 11:45 AM EDT

The United States has the world’s largest economy — a system so vast, complex, and interconnected that its movements affect global markets, trade flows, interest rates, and even the financial stability of other nations. From job creation and inflation to interest rate decisions and consumer spending, the U.S. economy influences nearly every aspect of daily life.

But what exactly drives the American economy forward? Why do recessions happen? How does the Federal Reserve shape business conditions? And why can a small change in interest rates impact everything from mortgage payments to stock markets?

This evergreen guide breaks down the U.S. economy in simple, clear language — making it understandable for everyday readers, students, investors, and anyone who wants to follow American financial news with confidence.

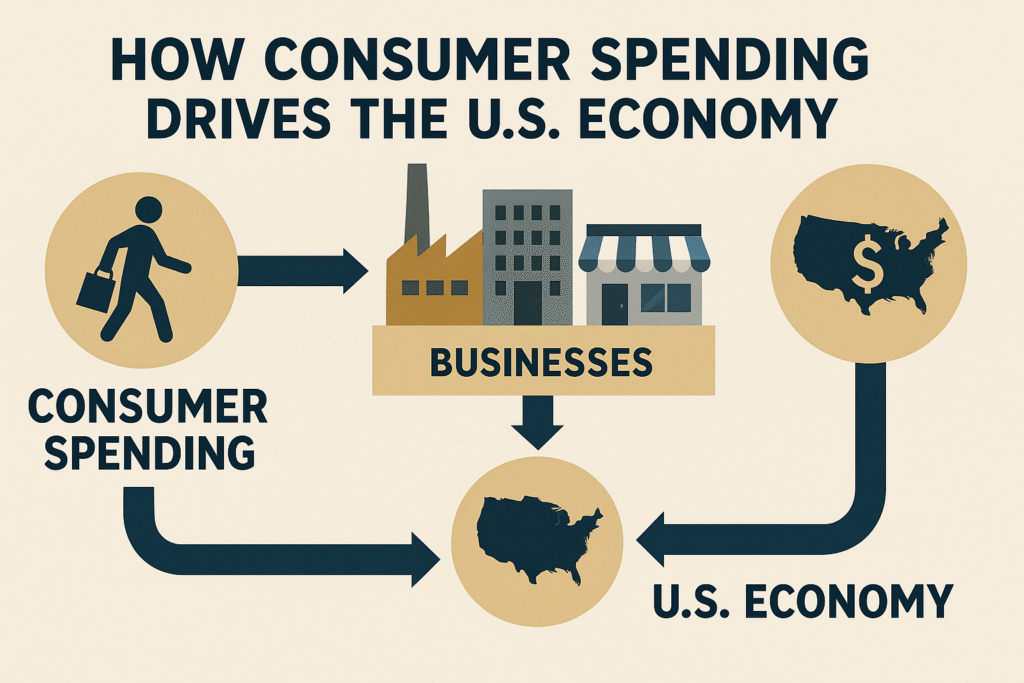

The Foundation: A Consumer-Driven Economy

The U.S. economy is powered primarily by consumer spending, which makes up nearly 70% of total economic activity. This includes:

- groceries

- cars

- travel

- entertainment

- healthcare

- retail purchases

When Americans spend more, businesses grow, profits rise, and jobs increase. When they spend less, economic growth slows and companies may reduce hiring or cut costs.

This consumer-based structure is why U.S. businesses pay close attention to:

- retail sales reports

- consumer confidence surveys

- holiday shopping trends

- credit card usage

If consumers are confident, the economy tends to grow.

Jobs: The Heartbeat of the Economy

Healthy job growth is one of the strongest signals of a strong economy. When more Americans work:

- incomes rise

- spending increases

- businesses expand

- tax revenue grows

Every month, the U.S. government releases the Jobs Report, a critical economic indicator watched by:

- Wall Street

- the Federal Reserve

- global investors

- employers

- economists

The jobs report includes:

- unemployment rate

- number of jobs added

- wage growth

- labor force participation

This data helps shape interest rate decisions, market expectations, and business planning.

Inflation: The Rising Cost of Living

Inflation measures how much prices increase over time. When inflation rises, everything from food to fuel becomes more expensive. Mild inflation is normal in a growing economy. But high inflation can:

- reduce purchasing power

- hurt low-income households

- push interest rates higher

- slow down business investment

The U.S. uses two main inflation indicators:

- Consumer Price Index (CPI) — measures everyday goods

- Personal Consumption Expenditures (PCE) — used by the Federal Reserve

High inflation forces policymakers to act — which brings us to the most influential institution in the U.S. economy.

The Federal Reserve: America’s Economic Compass

The Federal Reserve, or “the Fed,” controls U.S. monetary policy. Its two main goals are:

- Keep inflation low

- Maintain steady employment

To achieve this, the Fed adjusts interest rates.

When inflation is high:

The Fed raises interest rates, making:

- car loans

- credit cards

- business loans

- mortgages

more expensive.

This slows spending and business activity, helping inflation fall.

When the economy weakens:

The Fed cuts interest rates, making borrowing cheaper to:

- encourage investment

- boost hiring

- support economic growth

Every Fed meeting is closely followed by investors because interest rate changes ripple through the entire economy.

Business Cycles: Growth, Slowdowns, and Recessions

The U.S. economy moves in cycles:

1. Expansion

- jobs increase

- businesses hire

- consumers spend

- stock markets rise

2. Peak

The economy reaches its highest point before slowing.

3. Contraction

- spending falls

- companies cut jobs

- growth slows

4. Recession

A sustained period of economic decline, often triggered by:

- high inflation

- financial crises

- rapid interest rate hikes

- global shocks

- market imbalances

Recessions are painful but temporary. Historically, the U.S. economy has always recovered and grown stronger.

Stock Market: The Economy’s Emotional Barometer

The stock market is not the entire economy — but it reflects expectations about future growth.

Stock prices rise when:

- businesses report strong earnings

- inflation slows

- interest rates stabilize

- consumer spending remains solid

Stock prices fall when:

- inflation surges

- borrowing becomes expensive

- global uncertainty rises

Millions of Americans invest through:

- 401(k)s

- retirement accounts

- mutual funds

- brokerage apps

So stock market performance affects personal wealth and long-term financial security.

Global Trade: America’s Economic Network

The U.S. trades goods and services with nations around the world.

Top trading partners include:

- China

- Canada

- Mexico

- Japan

- the European Union

Trade impacts:

- product prices

- job markets

- supply chains

- business profits

Events like the pandemic and global shipping disruptions showed how interconnected modern economies have become.

Why Understanding the U.S. Economy Matters

The U.S. economy affects:

- interest rates for homes

- prices at supermarkets

- job opportunities

- government policies

- stock market investments

- global financial stability

Whether you follow the Federal Reserve, inflation reports, stock trends, or wage data, understanding the system helps you navigate daily life and make informed decisions.