By Harshit, Tokyo, NOV. 7

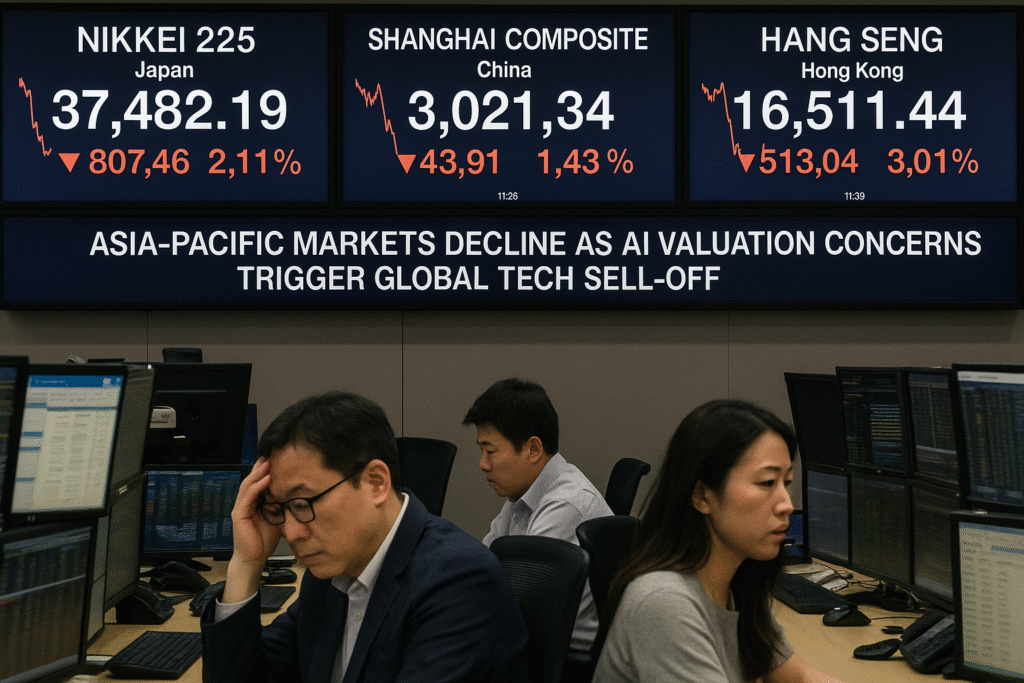

Asia-Pacific markets fell on Friday, mirroring declines on Wall Street as renewed concerns over lofty valuations in artificial intelligence-related stocks rippled through global markets. Shares of major AI companies slid sharply in the U.S. during Thursday’s session, weighing heavily on semiconductor, software, and hardware sectors across Asia.

The sell-off came as investors reassessed whether recent gains in AI-linked equities had run ahead of near-term earnings fundamentals. In particular, large-cap tech leaders Nvidia, Microsoft, Palantir Technologies, Broadcom, and Advanced Micro Devices were among the most notable decliners, prompting caution among traders in Asian markets with significant exposure to the semiconductor and chip supply chain.

Japan and South Korea Lead Regional Losses

Japan’s benchmark Nikkei 225 fell 1.19% to close at 50,276.37, pressured by sharp declines in major AI and semiconductor-linked companies. Telecommunications and technology investor SoftBank dropped 6.87%, while chip-testing equipment maker Advantest lost 5.54%. Renesas Electronics, a key global supplier of automotive and integrated circuit chips, declined 3.75%, and semiconductor equipment giant Tokyo Electron slipped 1.35%.

The Topix index ended slightly lower, closing at 3,298.85, as sentiment across Japan’s tech-heavy sectors softened.

South Korea’s markets were similarly affected, with the Kospi falling 1.81% to 3,953.76 in volatile trade. The small-cap Kosdaq dropped 2.38% to 876.81, led by losses across growth-focused technology shares. Memory chip giants Samsung Electronics and SK Hynix declined 1.31% and 2.19%, respectively, as investors rotated away from sectors perceived as overheated.

Chinese Markets Slip After Weak Trade Data

China’s markets also closed lower following weaker-than-expected trade data that underscored ongoing headwinds in the world’s second-largest economy. The Hang Seng Index in Hong Kong dropped 0.92% to 26,241.83, while the mainland CSI 300 fell 0.31% to 4,678.79.

Official data released Friday showed exports in October contracted 1.1% year-on-year in U.S. dollar terms — a sharp reversal from the 8.3% growth reported in September and below expectations for a 3% increase.

Imports also disappointed, rising 1% compared to expectations of 3.2%, down from 7.4% in the previous month.

Economists say the numbers reflect continued pressure from:

- Weak domestic consumption

- A prolonged real estate downturn impacting household confidence

- Rising job insecurity among younger workers

- Less aggressive stimulus support from Beijing

The data reinforced concerns that China’s recovery remains uneven and vulnerable to shifts in global trade and manufacturing demand.

India Outperforms Region, but Airtel Shares Fall

India’s major indexes saw more resilience than regional peers. The Nifty 50 edged 0.11% higher, while the Sensex was largely unchanged.

However, Bharti Airtel shares fell sharply after Singapore’s state-linked telecom group Singtel sold SG$1.5 billion ($1.15 billion USD) worth of its stake in the Indian carrier, reducing its holding from 28.3% to 27.5%. The transaction is part of Singtel’s broader asset recycling strategy, which has now generated SG$5.6 billion toward a medium-term monetization goal of SG$9 billion.

Singtel shares rose as much as 2.67% following the announcement, while Airtel declined up to 4.34%.

U.S. Futures Stabilize After Thursday’s Sell-Off

U.S. stock futures edged slightly higher during early Asian trading hours after the previous session saw steep declines. The Dow Jones Industrial Average fell 398.70 points (0.84%), while the S&P 500 declined 1.12%. The Nasdaq Composite, heavily weighted toward tech and AI innovators, dropped 1.9% — its worst single-day performance in several weeks.

Analysts say Friday’s stabilizing futures indicate that investors are not yet pricing in a prolonged downturn but are instead adjusting expectations after months of rapid gains in AI equities.

Outlook

Market strategists caution that near-term volatility may continue as investors reassess growth prospects for AI-linked companies heading into year-end earnings. While long-term demand for semiconductor and AI infrastructure remains strong, analysts warn that valuations in some sub-sectors may still reflect aggressive future earnings assumptions.

For now, global equity markets appear sensitive to any signs of cooling demand, softening trade flows, or adjustments in corporate spending on digital transformation.