By Harshit, WASHINGTON, D.C., November 1, 2025 — 8:30 AM EDT

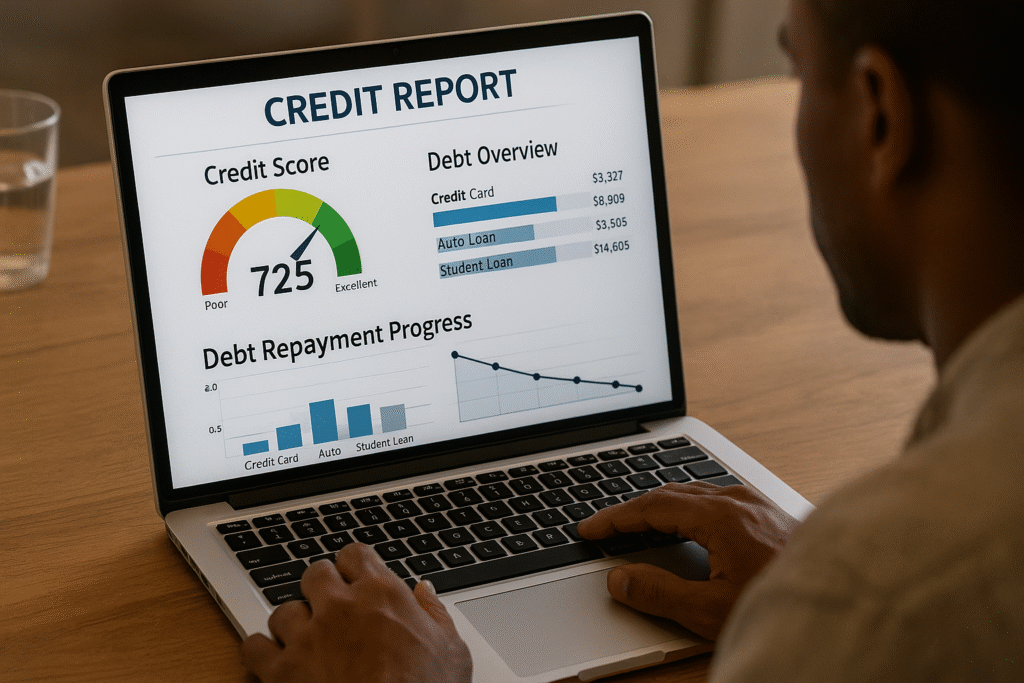

Your credit score isn’t just a number — it’s a financial lifeline. In 2025, lenders, landlords, and even employers are weighing it more heavily than ever before. With borrowing costs still elevated and credit markets tightening, maintaining a strong FICO score can determine how easily you secure a mortgage, refinance a car loan, or qualify for premium credit cards.

Quick Summary: To improve your credit score fast in 2025, pay bills on time, lower your credit utilization below 10%, dispute credit report errors, and use tools like Experian Boost or secured credit cards. Many Americans see improvements within 3–6 months.

According to FICO, payment history and credit utilization together make up 65% of your total credit score. And per a 2024 Experian report, the average U.S. FICO score stood at 717, with nearly 34% of Americans still considered subprime borrowers. The good news? With consistent, smart financial moves, you can change that fast.

1. Check Your Credit Report for Errors

Before making improvements, start with a clear picture. Every American is entitled to free weekly reports from Equifax, Experian, and TransUnion via AnnualCreditReport.com.

Check for:

- Incorrect account listings or duplicate entries

- Wrong balances or outdated negative marks

- Accounts that don’t belong to you

If you spot errors, file a dispute immediately with the credit bureau. They must investigate within 30 days. Removing an incorrect late payment or collection can raise your score by 20–100 points.

2. Pay Down Credit Card Balances Aggressively

Your credit utilization ratio (the percentage of used credit versus your limit) makes up about 30% of your FICO score.

Experts recommend keeping utilization under 30%, but those aiming for a quick boost should target below 10%.

Example:

If your total credit limit is $10,000, keep your balance under $1,000.

Quick Wins:

- Make multiple small payments each month.

- Request a credit limit increase if you have a strong payment history.

- Avoid using more than one-third of any card’s limit at a time.

3. Always Pay Bills on Time

Payment history determines 35% of your score — the most influential factor. Even a single missed payment can lower your score by 60–120 points.

Tips:

- Automate credit card and loan payments.

- If you miss a due date, pay ASAP and call your creditor — many offer “goodwill adjustments” for first-time errors.

- Use reminders or apps like Mint or YNAB to track due dates.

4. Become an Authorized User

Ask a family member or close friend with strong credit to add you as an authorized user on their card. Their responsible behavior (low utilization and timely payments) boosts your record too.

Ensure the issuer reports authorized user data to all three bureaus before proceeding. This tactic is especially useful for those new to credit or rebuilding after a setback.

5. Use Modern Credit-Building Tools

In 2025, several digital tools can help you establish or repair credit faster:

- Experian Boost: Adds on-time payments for utilities, rent, and subscriptions.

- Self Credit Builder Loan: Builds savings while establishing payment history.

- Secured Credit Cards: Use your deposit as collateral; payments are reported monthly.

Users of these programs often see visible improvements in three to six months.

6. Keep Old Accounts Open

Your credit age affects about 15% of your FICO score. The longer your accounts remain active, the better.

Even if you rarely use an old card, keep it open. Make a small purchase every few months to prevent closure from inactivity. Closing an old account can shrink your credit history and raise utilization, lowering your score.

7. Limit Hard Inquiries

Each new credit application triggers a hard inquiry, which can lower your score slightly. Multiple hard pulls within a short window look risky to lenders.

Smart Strategy:

- Space applications at least six months apart.

- Use soft inquiry pre-qualification tools.

- Focus on maintaining and optimizing existing credit.

8. Negotiate or Settle Old Debts

If you have collections or charge-offs, contact creditors to negotiate a “pay-for-delete” — removing the negative record in exchange for full payment.

If that’s not possible, ensure the account is marked “paid in full” rather than “settled”. It’s a small difference with a big impact on future lending decisions.

9. Track Your Progress Monthly

Monitor your score regularly using free apps like Credit Karma, Experian, or Chime Credit Builder. Regular tracking helps you stay motivated and detect changes quickly.

Remember, improving your credit isn’t a one-time task — it’s an ongoing habit.

Key Takeaways

- Pay bills on time — even one missed payment can hurt your score.

- Keep credit utilization under 10% for the fastest improvement.

- Dispute report errors through credit bureaus immediately.

- Use Experian Boost or secured cards to build positive payment history.

- Avoid closing old accounts and excessive hard inquiries.

Consistency, patience, and awareness are your biggest allies in building a 750+ credit score in 2025.

Final Thoughts

Raising your credit score doesn’t happen overnight, but in today’s digital finance ecosystem, smart strategies can accelerate progress. Most users who follow these steps diligently see measurable gains within 90–180 days.

With lenders becoming more selective and interest rates likely to stay high, there’s no better time to secure your financial future by mastering your credit profile.