By Harshit, Washington, D.C., October 29, 2025 – 9:00 AM EDT

Treasury Yields Remain Flat Ahead of Key Fed Announcement

U.S. Treasury yields held largely steady on Wednesday as investors awaited the outcome of the Federal Reserve’s two-day policy meeting, which is expected to result in another quarter-point rate cut. Market participants are also watching closely for any clues about the central bank’s plans regarding quantitative tightening (QT) — its ongoing balance sheet reduction process.

The 10-year Treasury yield edged up less than one basis point to 3.989%, while the 2-year yield was nearly unchanged at 3.50%. The 30-year bond yield was also up marginally to 4.555%, signaling investor caution ahead of the Fed’s announcement.

One basis point equals 0.01%, and Treasury yields move inversely to bond prices — meaning when yields rise slightly, demand for Treasuries typically softens.

Traders Expect Quarter-Point Rate Cut

According to the CME FedWatch Tool, traders are pricing in an almost 100% probability that the Federal Reserve will cut its benchmark interest rate by 25 basis points, bringing the target range to 3.75%–4.00%.

The expected move would mark the Fed’s second consecutive rate cut of 2025 as policymakers seek to balance economic resilience against emerging liquidity pressures. Market participants are also projecting another rate cut in December, signaling a more sustained easing cycle.

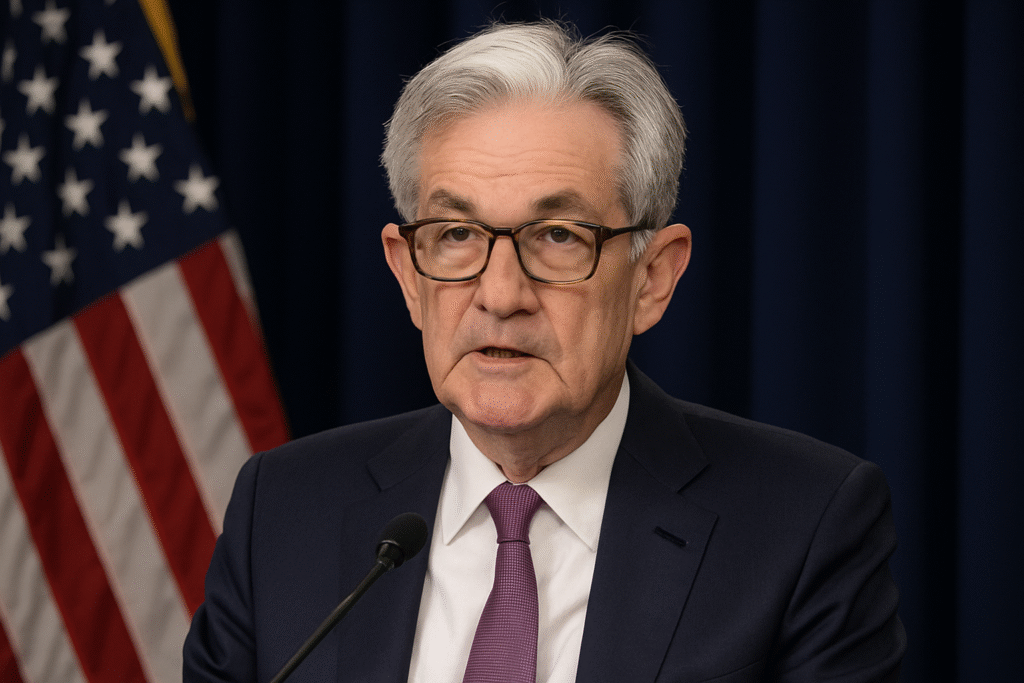

Fed Chair Jerome Powell will hold a press conference following the decision, and investors will be parsing his tone for signs of a more dovish or cautious policy stance moving forward.

Analysts Expect Focus on Balance Sheet and Liquidity

“With the U.S. government shutdown now in its fifth week, our economists anticipate that Chair Powell’s press conference will pivot away from economic data — given its scarcity — and instead focus on balance sheet policy, the policy framework review, and financial stability,” analysts at Deutsche Bank said in a note.

The prolonged shutdown has disrupted several key data releases, leaving policymakers to rely on secondary indicators and market signals. As a result, balance sheet strategy — particularly the end of QT — has become a major focal point for investors.

Markets Watch for End of Quantitative Tightening

In recent remarks, Powell hinted that the central bank may be nearing the end of its quantitative tightening process, saying the Fed “may approach that point in coming months” where reserve levels are sufficient to meet liquidity goals.

QT, or quantitative tightening, is the process by which the Fed reduces its holdings of Treasury and mortgage-backed securities, effectively draining liquidity from the banking system.

Recent tightness in money markets — including elevated overnight repo rates and declining use of the Fed’s overnight reverse repo facility — has added to speculation that the Fed may soon halt QT to prevent liquidity shortages.

Krishna Guha, head of global policy and central bank strategy at Evercore ISI, said he expects the Fed “will announce it intends to wrap up QT by December in light of money market pressures that suggest it is close to the ample region of reserves.” Guha even suggested that conditions could prompt the Fed to resume limited bond purchases in early 2026 if liquidity tightens further.

Similarly, Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, said it’s “a close call between now or the end of the year,” but he expects an announcement on QT in Wednesday’s statement.

Wall Street Revises QT Forecasts

The Bank of America (BofA) rates strategy team revised its expectations, now predicting that QT will wrap up this month, moving up its earlier projection from the end of the year.

BofA’s Claudio Irigoyen attributed the change to “comments from Powell and Fed Governor Christopher Waller, and ongoing tightening in liquidity conditions.” He added that “repo prints have been surprisingly elevated for this time of month, indicating that reserves are no longer abundant.”

This tightening in money market liquidity has raised concerns that continuing QT could disrupt funding markets — a risk the Fed is keen to avoid.

Broader Market and Global Outlook

Treasury traders are also monitoring U.S.-China trade relations as President Donald Trump prepares to meet Chinese President Xi Jinping in South Korea this week. Any progress — or tension — from the talks could influence bond market sentiment, particularly if trade developments affect inflation or global demand.

For now, the bond market remains in a holding pattern, awaiting Powell’s remarks for clarity on both the direction of interest rates and the timeline for ending QT. The Fed’s decision will set the tone for markets heading into the final months of 2025, influencing Treasury yields, equity valuations, and global liquidity conditions.