By Harshit, WASHINGTON, Oct. 27, 2025 9 AM EDT

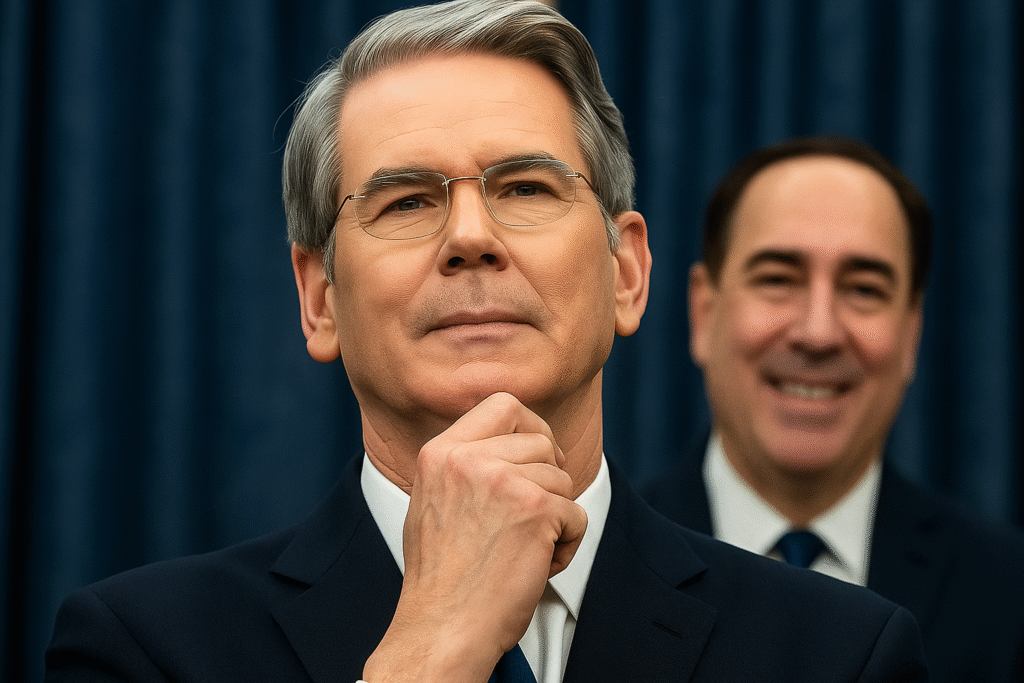

U.S. Treasury Secretary Scott Bessent confirmed Monday that the shortlist to replace Federal Reserve Chair Jerome Powell has been narrowed to five candidates, as President Donald Trump prepares to make one of the most consequential economic appointments of his second term.

The announcement comes just days before the Federal Open Market Committee (FOMC) meets to determine whether to cut interest rates again, with markets already pricing in a 25-basis-point reduction.

Finalists Revealed for the Fed’s Top Job

Speaking aboard Air Force One, Bessent told reporters that the final list includes:

- Christopher Waller, current Fed Governor

- Michelle Bowman, current Fed Governor

- Kevin Hassett, Director of the National Economic Council

- Kevin Warsh, former Fed Governor

- Rick Rieder, BlackRock executive and global fixed income chief

These names were first reported by CNBC earlier this month, but Monday’s remarks mark the first official confirmation from the Treasury Secretary.

“I’ve been conducting interviews and plan to do one more round before presenting a good slate to the President after Thanksgiving,” Bessent said. He added that the administration is seeking a “steady and disciplined leader” who can balance inflation control with employment growth.

Trump Eyes Decision by Year-End

President Trump, traveling alongside Bessent, told reporters he expects to announce Powell’s replacement by the end of the year, well before the chair’s term expires in May 2026.

“Jerome’s done his time,” Trump said. “We’re looking for someone strong on growth, smart on rates, and ready to move the economy forward.”

Powell, appointed by former President Joe Biden in 2022, can either step down entirely after his term as chair ends or remain as a governor on the Fed’s board until 2028. The final decision will likely depend on whether he wishes to continue influencing policy from a non-leadership position.

Fed Policy in Focus as Markets Await Decision

The timing of the leadership discussion adds fresh intrigue to this week’s FOMC meeting, where the central bank is widely expected to cut interest rates for the second consecutive time amid signs of cooling inflation and slower hiring.

Analysts say Trump’s move to finalize a shortlist now may signal his intention to reshape the Federal Reserve’s long-term direction — emphasizing looser monetary policy, lower borrowing costs, and greater alignment with White House economic goals.

Bessent, himself a former hedge fund executive before joining Treasury, has been vocal about his support for pro-growth monetary policies, though he has ruled out taking the Fed’s top job.

Trump’s Expanding Influence Over the Fed

Trump has already appointed three of the seven current Fed governors: Waller, Bowman, and Stephen Miran, who is serving a term that expires in January. Miran, confirmed in September as the head of the Council of Economic Advisers, has advocated for a more aggressive approach to rate cuts and is unlikely to be reappointed.

If Powell chooses to step down, Trump would gain the opportunity to name a fourth appointee, giving his administration majority influence over the Board of Governors. This would be the most significant shift in the Fed’s composition since the late 1970s.

Trump has previously clashed with the central bank over its interest rate strategy, arguing that the Fed’s caution slowed economic momentum. His new appointee could mark a turning point toward a more accommodative policy stance, potentially boosting investment and market confidence but also risking inflationary pressure.

Political and Economic Implications

Powell’s successor will inherit a complex economic landscape — one defined by moderate inflation (3%), a slowing labor market, and ongoing global uncertainty tied to tariffs and trade relations with China.

Former Fed Governor Kevin Warsh, known for his market-friendly stance and experience during the 2008 financial crisis, is viewed as a front-runner among investors. However, Rick Rieder’s deep ties to the private sector and Christopher Waller’s steady hand as a policymaker could also appeal to the administration.

Analysts note that Trump’s decision may also hinge on political optics heading into the 2026 midterm elections, where a dovish Fed chair could help sustain economic optimism and stock market performance.

A Critical Appointment on the Horizon

The Federal Reserve chair is among the most influential positions in global finance, steering policy decisions that affect everything from mortgage rates and job creation to inflation and international markets.

“Replacing Powell will set the tone for the next decade of U.S. monetary policy,” said Diane Swonk, chief economist at KPMG. “The next chair must balance political expectations with market realities — a challenging task under any administration.”

As the nation awaits the Fed’s interest rate decision this week, the selection of Powell’s successor adds yet another layer of uncertainty — and anticipation — to the U.S. economic outlook.