By Harshit | Washington, D.C., October 10, 2025 | 8:30 AM EDT

A Stark Warning Ahead of IMF Annual Meetings

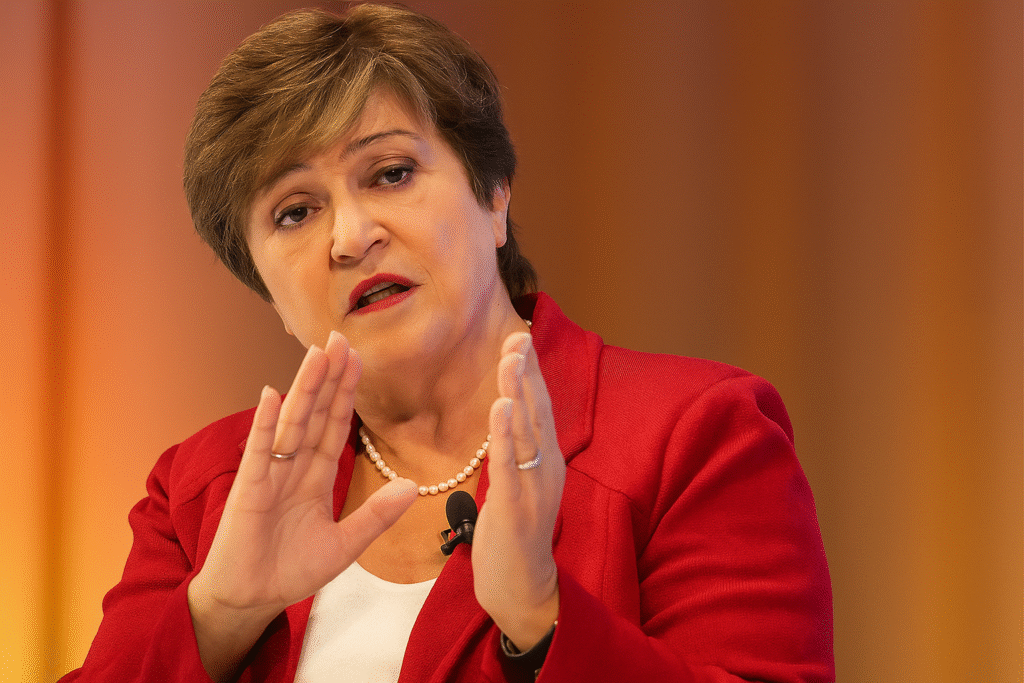

The head of the International Monetary Fund (IMF), Kristalina Georgieva, has issued one of her strongest warnings yet about the precarious state of the global economy, cautioning that “uncertainty is the new normal.” Speaking ahead of the IMF’s annual meetings in Washington next week, Georgieva emphasized that while the global economy has demonstrated surprising resilience in the face of ongoing disruptions, the risks ahead could prove more challenging than anticipated.

Her comments come at a pivotal time, with finance ministers and central bankers from around the world preparing to discuss economic strategies amid a climate of slowing growth, rising market volatility, and persistent geopolitical tensions.

U.S. Resilience Amid Tariffs

Despite historic tariffs imposed by the Trump administration, the U.S. economy has managed to sidestep recession. According to Georgieva, the American economy continues to expand modestly, and global GDP is expected to slow “only slightly this year and next.”

However, she noted that this resilience may prove deceptive. Many companies front-loaded exports earlier this year to avoid tariff impacts, meaning the full effect of these policies has not yet been felt. “Global resilience has not yet been fully tested,” she warned, stressing that the real economic consequences of trade restrictions are likely to unfold in the months ahead.

Warning Signs Flashing

Several economic indicators suggest that cracks may already be forming. Gold prices surged past $4,000 an ounce last week—a record high that analysts view as a signal of investor anxiety. Meanwhile, U.S. stock markets continue to soar, powered by surging valuations of the so-called “Magnificent Seven” tech companies, including Nvidia and Tesla.

“Before anyone heaves a big sigh of relief, please hear this: global resilience has not yet been fully tested. And there are worrying signs the test may come,” Georgieva cautioned at the Milken Institute in Washington.

The IMF’s July World Economic Outlook projected global GDP growth at 3% for 2025, a slight decline from 3.3% in 2024. Updated forecasts will be released during next week’s meetings, where policymakers will weigh the balance between resilience and risk.

Echoes of the Dotcom Bubble

Georgieva drew a pointed comparison between current U.S. stock valuations and the dotcom bubble of the late 1990s. She argued that today’s optimism, fueled by advances in artificial intelligence and productivity expectations, could easily tip into dangerous territory if investor sentiment shifts.

“Today’s valuations are heading toward levels we saw during the bullishness about the internet 25 years ago,” she remarked. “If a sharp correction were to occur, tighter financial conditions could drag down world growth, expose vulnerabilities, and make life especially tough for developing countries.”

The concern reflects growing unease among economists that financial markets may be overstating the durability of global growth, masking underlying weaknesses such as slowing job creation in the United States and fragile fiscal balances in emerging markets.

The Calm Before the Storm?

For now, financial markets remain broadly calm, with volatility contained despite ongoing policy turmoil. But Georgieva stressed that this calm could prove misleading. “History tells us this sentiment can turn abruptly,” she said.

She added that the combination of high equity valuations, record commodity prices, and slowing labor markets represents a dangerous mix that could exacerbate economic fragility if external shocks materialize.

A Call for Preparedness

Georgieva’s remarks serve as both a warning and a call to action. For advanced economies, the challenge lies in maintaining policy stability while addressing structural weaknesses. For developing nations, the stakes are even higher. A global slowdown or financial shock would disproportionately harm vulnerable economies already grappling with high debt burdens and limited fiscal space.

As the world prepares for the IMF’s high-level meetings, Georgieva’s message is clear: the global economy may be resilient, but that resilience is untested. With trade disputes, geopolitical risks, and potential financial corrections looming, the world must brace for a period where “uncertainty is here to stay.”