By Harshit | October 8, 2025 | London

EU Tariff Announcement Sparks Market Reactions

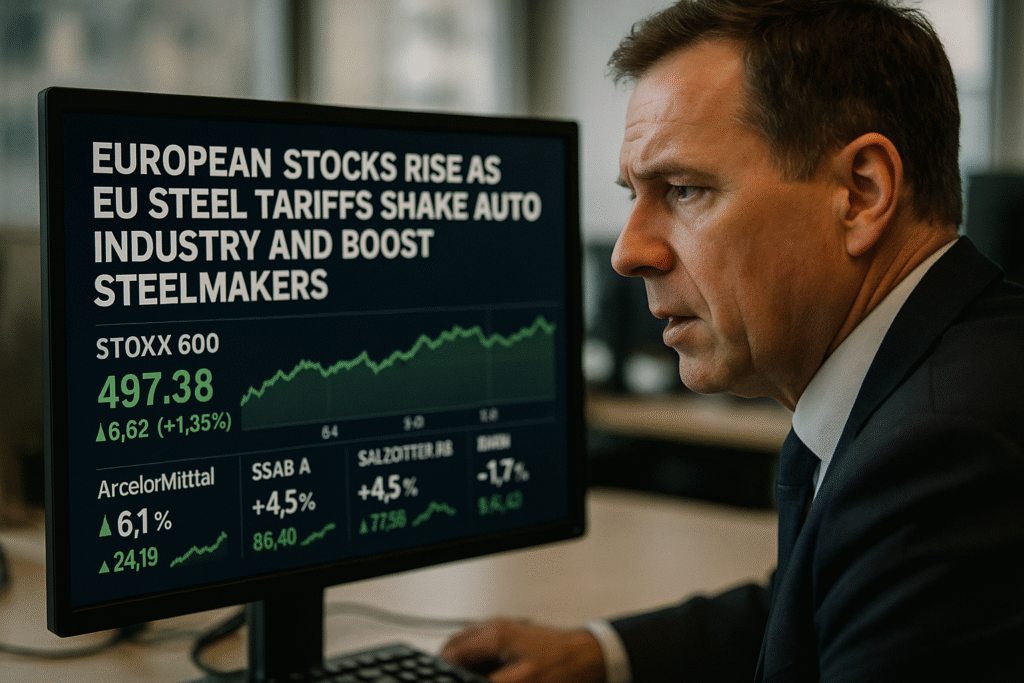

LONDON — European stocks closed higher on Wednesday even as investors weighed the European Union’s decision to impose steep new tariffs on steel imports, a move that has divided industries across the region.

The pan-European Stoxx 600 index rose 0.6% by 3 p.m. in London (10 a.m. ET), with nearly all major benchmarks advancing:

- CAC 40 (France): 8,046.97 (+0.90%)

- FTSE MIB (Italy): 43,445.53 (+0.87%)

- FTSE 100 (U.K.): 9,539.19 (+0.59%)

- DAX (Germany): 24,603.81 (+0.89%)

- IBEX 35 (Spain): 15,668.50 (+0.91%)

- Stoxx Europe 600: 573.21 (+0.69%)

The EU announced that tariff-free quotas on imported steel will be cut, and duties on imports exceeding those limits will be doubled from 25% to 50%. Officials argue the step is necessary to counter global overcapacity and protect European steel producers, but critics say the measure risks damaging downstream industries that rely on affordable steel.

Steelmakers Surge While Automakers Sink

European steel stocks were the clear winners of the day. ArcelorMittal jumped 5.2%, Thyssenkrupp climbed 4.6%, and Sweden’s SSAB rose 4.2% as investors bet on stronger pricing power for domestic producers.

By contrast, the auto sector suffered sharp losses. Rising steel costs threaten to erode already thin margins for carmakers facing weak demand in China and pressure from electric vehicle competitors. BMW slid 7% after lowering its profit margin outlook, citing both tariff concerns and slower sales in Asia. Daimler Truck dropped 3.1% and Mercedes-Benz lost 2.7%, contributing to the auto sector’s worst day in weeks.

The European Automobile Manufacturers’ Association (ACEA) urged the EU to reconsider the policy. Director General Sigrid de Vries said:

“We need to find a better balance between the needs of European producers and users of steel. Higher costs will inevitably ripple through the supply chain, affecting jobs and competitiveness.”

Corporate Spotlight: SoftBank Buys ABB Robotics

Outside of steel and autos, corporate headlines influenced trading across sectors. Japanese investment giant SoftBank Group announced a $5.4 billion acquisition of ABB’s robotics division, a move signaling deeper investment in industrial automation and AI-driven manufacturing.

ABB shares initially surged to a two-year high before easing back, closing down 0.3% in afternoon trade. Analysts described the divestment as part of ABB’s broader strategy to streamline operations while allowing SoftBank to expand its robotics portfolio.

Political Uncertainty in France

Markets also digested fresh political turmoil in France, where Prime Minister Sebastien Lecornu resigned after just 27 days in office. His departure underscores mounting instability for President Emmanuel Macron, who has given Lecornu until Wednesday evening to negotiate with opposition parties in hopes of averting a prolonged crisis.

The uncertainty weighed slightly on French banking and energy shares, though gains in industrials and steelmakers helped the CAC 40 finish higher overall.

Global Market Overview

European movements followed a mixed global backdrop:

- Asia-Pacific markets ended largely flat overnight, diverging from Wall Street.

- U.S. markets saw the S&P 500 edge higher after breaking a seven-day winning streak. Weak earnings from Oracle raised doubts about the durability of the AI-driven rally, while the ongoing U.S. government shutdown added another layer of uncertainty.

Outlook: Balancing Protectionism and Growth

Analysts warn that the EU’s decision to raise steel tariffs highlights the tension between protecting local industries and supporting broader economic competitiveness. While steelmakers benefit immediately, automakers and construction firms may face rising costs, potentially slowing demand in sectors critical to Europe’s growth.

“Policymakers will need to carefully calibrate their next steps,” said Raffaella D’Amico, a senior markets strategist in Milan. “What looks like a win for steel today could be a drag on industrial output tomorrow.”

For now, however, European investors appear willing to look past the risks. Gains in steel and industrials helped offset losses in autos, leaving continental markets in positive territory. But as the political crisis in France deepens and global trade tensions mount, volatility is expected to remain a defining feature of Europe’s financial landscape in the weeks ahead.