By Harshit, New Delhi, October 2, 2025 – 8:30 AM IST

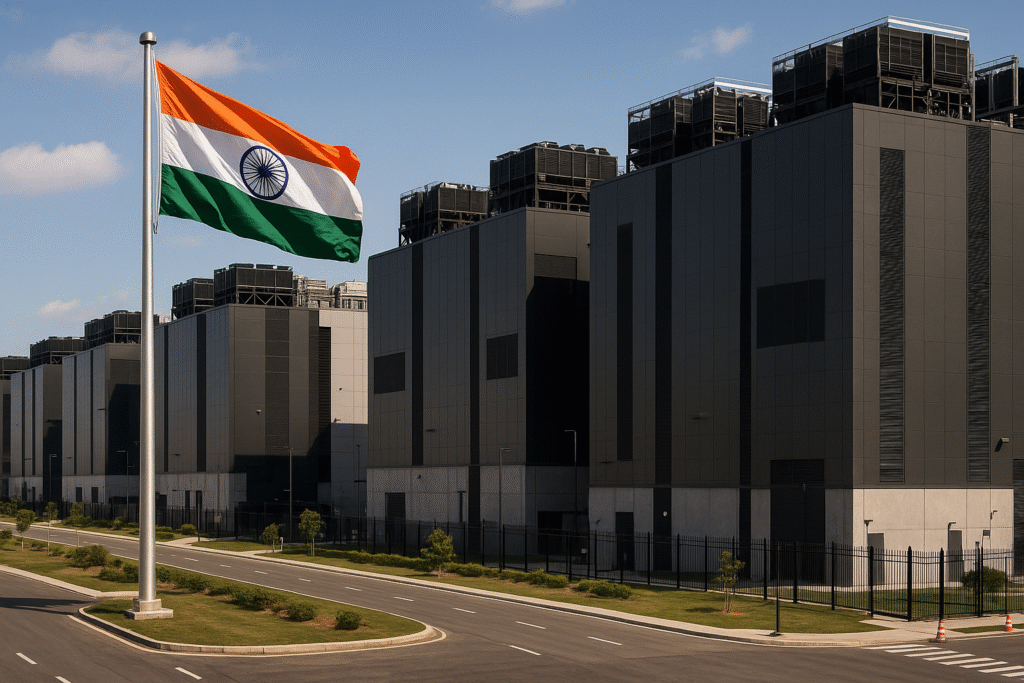

A Gold Rush in India’s Digital Backbone

India is witnessing a surge of investment in its rapidly expanding data center industry, as global tech giants, Indian billionaires, and even luxury real estate developers rush to stake their claim. Current data center capacity in India stands at around 1.2 gigawatts, a small fraction of global capacity, but industry forecasts predict the market will more than double to exceed 3 gigawatts within the next five years, according to Colliers International.

The scale of ambition is evident: tech giants like Google have reportedly held talks with the Andhra Pradesh government to establish a 1-gigawatt facility, while OpenAI is exploring plans for a similar-scale hub in India. These developments highlight a major shift from facilities traditionally measured in tens of megawatts to multi-gigawatt projects, often spearheaded by “hyperscalers” — companies with enormous computing power needs.

Competition Heats Up

More than 15 global and domestic players are now vying for market share. Leading international operators include Japan’s NTT, Singapore’s Temasek-backed STT GDC, and U.S.-based Equinix. Indian conglomerates such as Adani Group and Reliance Industries are also investing heavily.

Luxury and residential real estate developers are pivoting to digital infrastructure as well. Yotta Infrastructure by Hiranandani Group, Delhi-based Anant Raj Developers, and Pune-based Panchshil Realty are targeting the hyperscaler market, betting billions to transition from housing to “digital landlords.”

Drivers of the Data Center Surge

The boom is fueled by structural shifts in demand. Enterprises currently account for 60% of data center usage, hyperscalers 30%, and AI workloads around 10%, according to Anarock Capital. Shobhit Agarwal, CEO of Anarock, predicts hyperscaler usage could rise to 35%, while AI-specific workloads may climb 20–25% in the near future.

Enterprise demand has been bolstered by India’s digitalization of banking and data localization rules that mandate Indian financial data be stored domestically. Meanwhile, e-commerce growth and cloud adoption fueled a second wave of data center expansion. The third and current wave is being driven by AI workloads.

Equinix recently launched its first AI-focused facility in Chennai, marking expansion into a second Indian state. Manoj Paul, country managing director at Equinix, noted that 60% of its global revenues come from customers operating across multiple regions, many of whom are keen to expand into India.

Why India?

India offers several competitive advantages. Unlike mature data center hubs in Singapore, Japan, Australia, and China, India has ample land for large-scale projects, relatively lower power costs, and growing renewable energy capacity — all crucial for energy-intensive facilities. Local demand, including new rules on social media data storage, further strengthens the investment case.

Facilities are increasingly being designed to handle larger workloads. “Earlier, enterprise-driven capacity rarely exceeded 10 megawatts. Hyperscalers demand 25–50 megawatts, and AI workloads could require 75–100 megawatts,” said Alok Bajpai, managing director of NTT Data Systems India.

Billionaire-Led Ambitions

Indian billionaires are reshaping the market. Gautam Adani’s joint venture with EdgeConneX, AdaniConnex, is scaling from under 40 megawatts to 210 megawatts. Mukesh Ambani’s Reliance is reportedly planning a 3-gigawatt mega data center in Gujarat, with a $20–30 billion investment.

Smaller developers are also investing aggressively. Anant Raj Developers aims for 300 megawatts of capacity by 2032, and its stock price has more than doubled since entering the sector in 2023.

Challenges and Roadblocks

India’s regulatory environment remains complex. Developers face more than 30 approvals across various agencies, leading to delays. U.S.-based Colt, for instance, took six years to operationalize a 100-megawatt Mumbai site, initially building just 22 megawatts. To accelerate expansion, Colt entered a $1.7 billion joint venture with RMZ Infrastructure in 2024 to develop 250 megawatts across Navi Mumbai and Chennai.

Land acquisition presents another hurdle. Data centers require large, dispute-free parcels, and unclear land titles can create corporate governance risks. Some domestic property groups capitalize on these delays by resolving land issues and leasing or operating centers themselves.

Outlook: Competition and Consolidation Ahead

While the boom promises significant opportunities, the rush of entrants may trigger oversupply and price competition. “India is significantly down on pricing compared with Indonesia due to competition for hyperscaler accounts,” said Devi Shankar, senior executive director at CBRE India. Analysts expect some consolidation in the next 2–3 years.

For now, the race to dominate India’s data center market remains wide open, as domestic and international players compete to build the backbone of the country’s digital future.