Washington, D.C., October 1, 2025 – 8:30 AM EDT By Harshit

Yields Fall Amid Weak Economic Signals

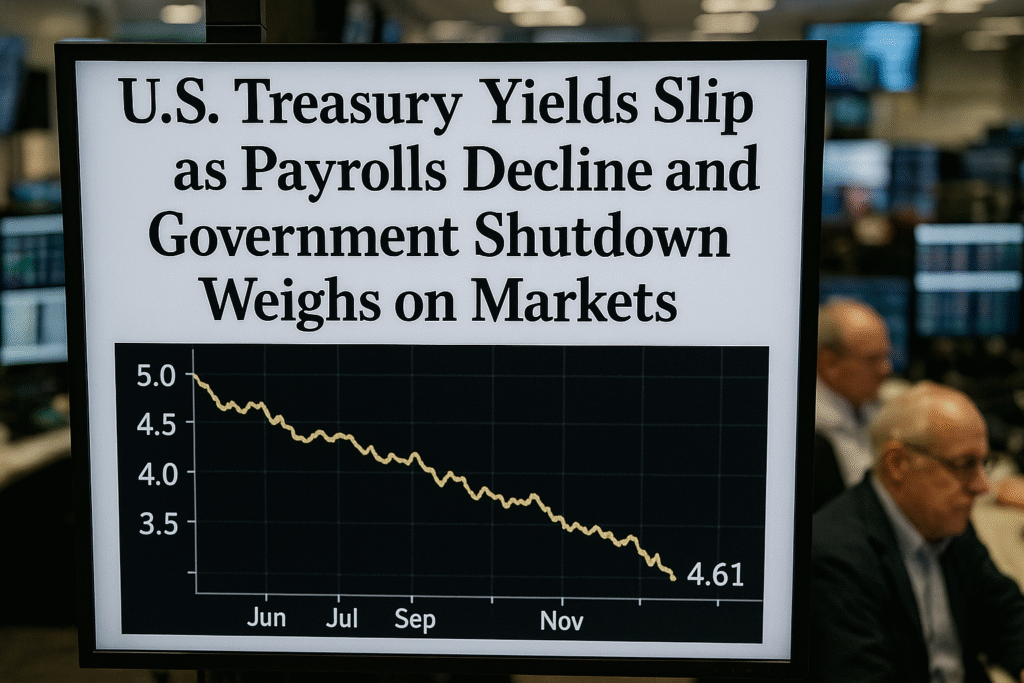

U.S. Treasury yields fell on Wednesday after fresh data from ADP revealed a surprise decline in private payrolls, while traders continued to weigh the implications of the ongoing federal government shutdown.

The benchmark 10-year Treasury yield slid nearly 5 basis points to 4.102%, while the 30-year bond yield shed more than 3 basis points to 4.70%. Yields on shorter-term debt also moved lower, with the 2-year yield falling 4.9 basis points to 3.555%.

The moves reflected investor unease over weakening labor market trends and heightened political risk in Washington, as the funding stalemate left markets without the government’s official September jobs report.

Payrolls Shock: ADP Reports Unexpected Decline

According to ADP’s monthly report, private payrolls dropped by 32,000 in September. This was a stark miss compared with the Dow Jones estimate of a 45,000 increase. August figures were also revised downward, showing a small loss of 3,000 jobs instead of the previously reported 54,000 gain.

The report immediately rattled markets, as investors rely more heavily on private payroll data during the shutdown, which has delayed the Bureau of Labor Statistics’ monthly jobs release. Economists warned that the figures suggest the labor market may be softening faster than expected, despite prior resilience.

“This was not the number markets were expecting,” said Sarah Reynolds, senior economist at Capital Economics. “With government data offline, ADP’s figures take on more importance, and they are flashing early warning signs of a slowdown.”

Shutdown Amplifies Uncertainty

The U.S. government entered shutdown mode early Wednesday after the Republican-controlled Senate and the White House failed to reach an agreement on a short-term spending bill. The dispute centered on Democrats’ push to extend health care tax credits, a move Republicans rejected.

President Donald Trump accused Democrats of refusing to compromise, stating: “I didn’t see them bend even a little bit.” He also suggested the shutdown could result in permanent layoffs, a new and politically risky escalation in his rhetoric.

Historically, government shutdowns have had limited long-term economic effects, with federal employees eventually receiving back pay. However, economists warn that this standoff could prove different due to its duration and the political brinkmanship involved.

Risks to Credit Quality and Fed Policy

Beyond the immediate labor market concerns, investors are increasingly worried about the potential long-term effects of the shutdown on U.S. creditworthiness. Moody’s downgraded the U.S. sovereign credit rating in May and has since warned that prolonged political dysfunction could trigger further downgrades.

“If this shutdown drags on, it raises concerns not just about data availability but about the broader credibility of U.S. institutions,” JPMorgan analysts wrote in a client note. The bank described the scenario as a possible “tail risk” for Treasury investors, with higher yields emerging if debt sustainability is questioned.

The Federal Reserve also faces a more complicated policy landscape. While markets widely expect the Fed to cut interest rates by half a percentage point before year’s end, weaker labor data coupled with political gridlock could accelerate those plans.

Market Outlook

Bond market analysts say the latest developments could fuel near-term volatility. Some see room for further yield declines if labor market weakness deepens, while others caution that renewed credit risk fears could quickly reverse the trend.

“The history of shutdowns is that they don’t usually cause lasting economic damage,” William Lee, chief economist at the Milken Institute, told CNBC. “But this time, both sides are being very strategic. That makes this a higher-stakes situation than usual.”

As markets await clarity, attention now turns to whether lawmakers can strike a deal to reopen the government. In the meantime, investors will continue to rely on private data releases like ADP’s payroll report to guide expectations for the economy and the Fed’s next moves.