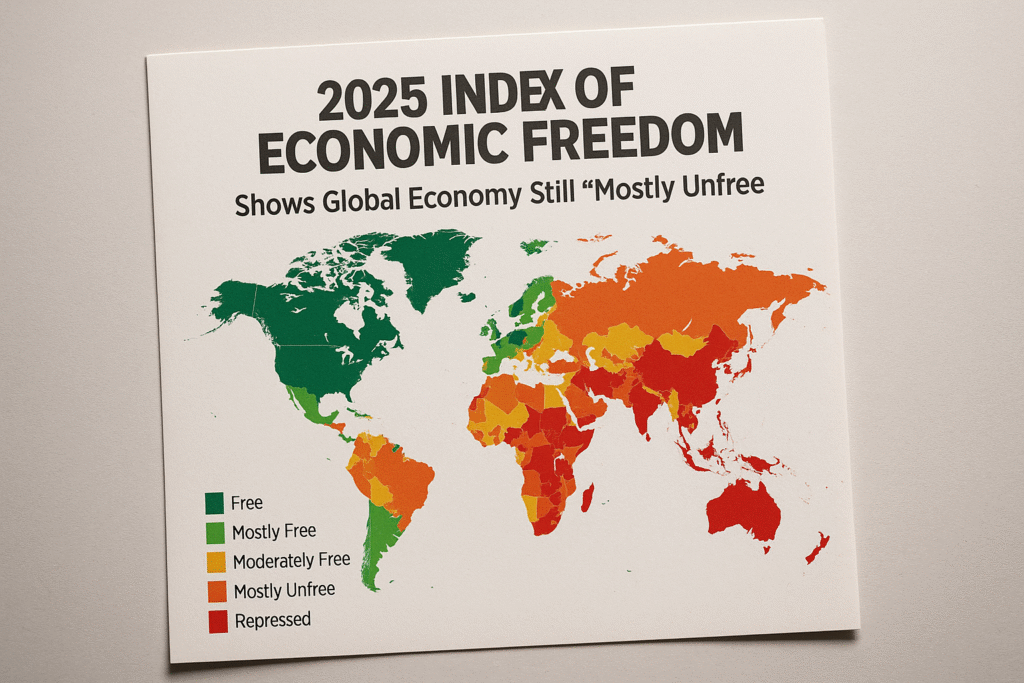

By HARSHIT, Washington, D.C., September 29, 2025 – 5:30 AM EDT: The fragility of the global economy was once again underlined this morning with the release of the 2025 Index of Economic Freedom, which shows that despite slight improvement, the world remains “mostly unfree.” The annual report, published by the Heritage Foundation, revealed that the global average economic freedom score has increased by 1.1 points, rising from 58.6 in 2024 to 59.7 this year.

However, only three countries managed to achieve the coveted status of “economically free,” down from four in the previous year, underscoring the persistent challenges facing governments and markets worldwide.

Economic Growth

The Index evaluates 176 countries based on measures such as rule of law, government size, regulatory efficiency, and market openness. While the incremental rise in the global score signals some progress, economists caution that the recovery is uneven and vulnerable to shocks.

“Economic freedom is the cornerstone of growth, but the global average remaining below 60 shows just how fragile our economic systems are,” said one senior researcher involved in the Index.

The data comes at a time when the world economy is under pressure from slowing trade flows, high public debt, and weak labor markets. Global GDP growth for the second quarter of 2025 was revised upward to 3.8% annualized, but economists warn the pace is heavily reliant on consumer spending in wealthier nations rather than broad-based structural reform.

Inflation and Deflation Pressures

The Index also highlights how many economies continue to grapple with inflationary pressures. The U.S. core inflation rate currently sits at 2.9%, still above the Federal Reserve’s target of 2%, while several emerging markets are facing price volatility linked to energy and food supplies.

At the same time, some European economies are showing signs of deflationary risk as consumer demand weakens. This divergence points to a global economy where stability is fragile, and policymakers face different but equally complex challenges.

Market Reactions

Financial markets responded cautiously to the release of the report. The Dow Jones Industrial Average has risen over 9% year-to-date, while the Nasdaq Composite is up more than 23%, buoyed by strong corporate earnings and surging investment in artificial intelligence.

Yet, concerns remain that such market optimism is masking underlying risks. “The economy’s very vulnerable if the stock market turns south, for whatever reason,” warned Mark Zandi, Chief Economist at Moody’s Analytics. “In the current context of no job growth, that’s a recipe for recession.”

The University of Michigan’s consumer sentiment survey also showed a clear divide: households with large stock holdings remain optimistic, while those with smaller or no holdings reported declining confidence. This gap reflects how rising equity markets have disproportionately benefited wealthier households.

Policy and Government Actions

Governments across the globe continue to wrestle with how to stimulate growth without fueling inflation or adding to already strained public debt. The U.S. Federal Reserve is expected to move toward a rate cut in October, with the possibility of another in December, as officials seek to balance inflation control with economic momentum.

Meanwhile, many emerging markets have turned to targeted subsidies and regulatory reforms in an effort to attract investment and stabilize their currencies. However, the Index notes that excessive government involvement in markets continues to stifle innovation and entrepreneurship in many regions.

Outlook and Analysis

While the slight increase in the 2025 global score may offer some optimism, analysts stress that long-term stability requires deeper reforms.

The reduction from four to three “economically free” countries highlights how difficult it is to sustain truly open and competitive markets. Regional disparities remain stark:

- Asia-Pacific nations saw small improvements in digital trade and infrastructure.

- Europe maintained some of the freest economies but faced energy instability and fiscal risks.

- Latin America and Africa continued to struggle with governance issues, corruption, and inconsistent policy implementation.

“Despite the incremental rise, the fact that the world remains mostly unfree tells us that policymakers need to do more than just react to crises,” said an economist from a Washington-based think tank. “They need to build resilient institutions that can support long-term prosperity.”

Conclusion

The 2025 Index of Economic Freedom serves as both a warning and a guide. While global economic freedom has improved slightly, the world remains “mostly unfree” and vulnerable to shocks. For leaders, the message is clear: true growth and stability will only come with reforms that reduce government overreach, protect property rights, and expand opportunities for trade and investment.

As September 29, 2025 begins, policymakers, investors, and citizens alike are left to weigh the fragile balance of progress against the risks still embedded in the global economy.